3.60m True Width @ 29.1 g/t gold intercept and 4.10m True Width @ 15.23 g/t gold

Breaking News:

If Mozart were alive today, how would he feel about the Music-Domains?

Fachkräfteeinwanderung: Südwesttextil im Gespräch mit Justizministerin

Saisonbeginn am Pilatus: Es locken top Aussichten und viele Erlebnisse

Filmboard Karlsruhe wird Mitglied im Bündnis für Demokratie und Menschenrechte Karlsruhe

Kathmandu Nepal

Samstag, Mai 18, 2024

Highlights

Mark Child, Chairman and CEO commented:

“I am delighted with the initial results of the 7800 metre infill drilling programme on our permitted high grade Mestiza Open Pit, which is targeted for early production. The high grade drill intercepts announced today of 4.1 m true width at 15.23 g/t gold and 3.6 m true width at 29.1 g/t gold, approximately 40 m and 85 m respectively below surface may add to our mineral resource inventory at Mestiza and possibly improve the Project’s economics, although this will only be confirmed at the conclusion of this drilling campaign.

The September 2021 PEA estimated the Mestiza Open Pit can currently deliver a fully diluted mill feed of 499Kt at 5.37g/t gold for 86,000 oz gold. The tighter drill spacing has delivered relatively shallow, high grade drill intercepts which add considerable confidence to the existing monthly mine schedules”.

About the Mestiza Open Pit

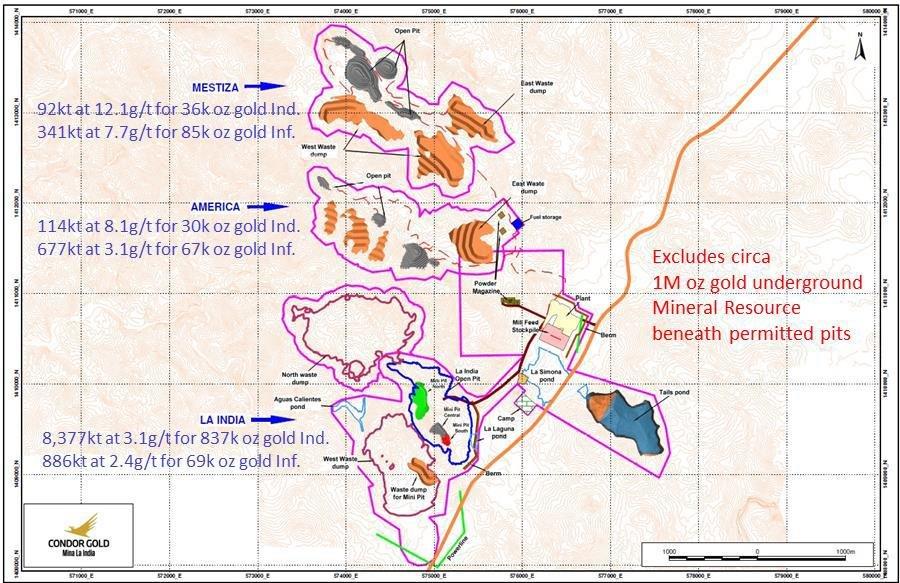

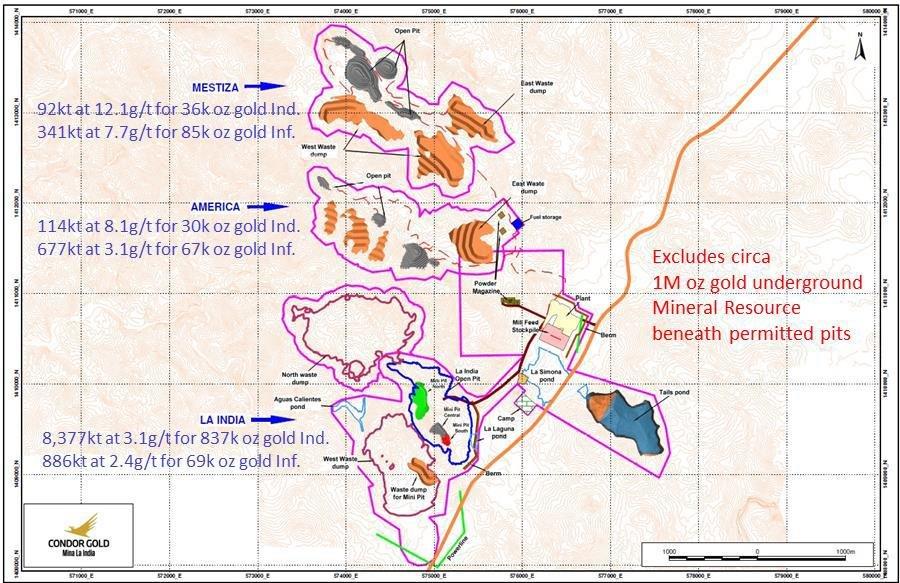

The Mestiza Open Pit sits within the La Mestiza Vein Set, which host a high grade open pit Mineral Resource Estimate (“MRE”) of 432kt at 8.6g/t gold (92kt at 12.1g/t gold for 36,000 oz gold in the Indicated Category and 341kt at 7.7 g/t gold for 85,000 oz gold in the in the Inferred Category), and an underground Mineral Resource of 118kt at 5.5g/t gold in the Indicated category and 984kt at 5.3 g/t gold for 169,000 oz gold in the Inferred category (see RNS dated 28 January 2019 and Table 1 below). The Mestiza Vein Set is part of Condor’s 100% owned La India Project (the “Project”).

On 9 September 2021, Condor announced the key findings of a technical report on the Project prepared by SRK Consulting (UK) Limited (“SRK”). This technical report (the “Technical Report”) presents the results of a strategic mining study to Preliminary Economic Assessment (“PEA”) standards completed on the Project in 2021 (See RNS dated 9 September 2021). The 2021 PEA Technical Report will be issued within 45 days of the public disclosure to NI 43-101 standards. The PEA includes open pit mining scenarios containing mill feed from the Mestiza Open Pit. The estimated fully diluted feed mill feed for the PEA is 499Kt at 5.37g/t gold for 86,000 oz gold. Assuming a 91% metallurgical recovery and a gold price of US$1700 per oz, gold production would be 78,260 oz gold and revenues US$133M.

The Mestiza Vein Set is located only 3 km from the permitted processing plant on Condor’s La India Project, comprises of several gold-bearing quartz veins spread across an 800 m wide corridor, and striking for 1500 m to 2000 m in north-northwest to south southeast direction along the top of a broad ridge (see Figure 1). The gold mineralised veins are contained within steep-dipping faults and to a lesser extent as breccia and stockwork veinlets within fracture zones on the walls of the faults. The gold mineralisation is best developed where the host rock on both sides of the fault is a hard, welded volcanic tuff. The high-grades occur with the faults where early quartz veins and quartz breccias have been ground to fault breccia, quartz sands or even fault clays by movement along the fault planes. A later stage, post-fault quartz mineralisation is recognised in some places overprinting the fault breccias and sands. The gold mineralisation is interpreted to be associated with both phases of quartz development.

The La Mestiza Vein Set is open along strike and down dip and has parallel veins identified by rock chip sampling, which are outside the area of Mestiza Vein Set’s MRE. The MRE of the deposit can potentially be increased in size with further drilling.

About the Infill Drilling

The first phase of 3371.58 m of infill drilling has ‘tightened-up’ the drill spacing from a mix of 50 m to 100 m spacing to a regular 50 m along strike and 50 m down-dip grid. A second phase of approximately 4500 m of infill drilling to 25 m along strike and 50 m down-dip spacing is currently underway in the area of the principal open pit resource on the Tatiana Vein. The objective of the drilling program is to further improve the confidence of the geological model and future mine schedules, aiming to upgrade a significant proportion of the 85,000 oz gold open pit MRE in the Inferred category to the Indicated category.

Discussion of the Assay Results

Assay results are generally consistent with the previous wider spaced drilling. High-grade gold intercepts have been returned from the drill holes that infill between previous high-grade intercepts, and are interpreted to demonstrate good continuity of gold mineralization in the area. (Table 1 below shows the top 8 drill intercepts to-date). The Company notes that the best drill intercept from Mestiza Open Pit to-date has been of returned at the base of the principal open pit with 3.90 m (3.6 m true width) at 29.1 g/t gold from 105.70 m in drill hole LIDC471. This is supported approximately 50 m up-dip and 25 m along strike by an intercept of 4.5m (4.11m true width) at 15.23g/t gold from 47.8m drill depth (drill hole LIDC514). The second phase of infill drilling to 25 m along strike by 50 m down-dip drill sample spacing in the areas of the open pits is underway with the goal to add further confidence to the geological model and mineral resource estimate.

About Condor Gold plc:

Condor Gold plc was admitted to AIM in May 2006 and dual listed on the TSX in January 2018. The Company is a gold exploration and development company with a focus on Nicaragua.

In August 2018, the Company announced that the Ministry of the Environment in Nicaragua had granted the Environmental Permit (“EP”) for the development, construction and operation of a processing plant with capacity to process up to 2,800 tonnes per day at its wholly-owned La India gold project (“La India Project”). The EP is considered the master permit for mining operations in Nicaragua.

La India Project contains a Mineral Resource of 9,850 Kt at 3.6 g/t gold for 1.14 M oz gold in the Indicated category and 8,479 Kt at 4.3 g/t gold for 1.18 M oz gold in the Inferred category. A gold price of $1,500/oz and a cut-off grade of 0.5 g/t and 2.0 g/t gold were assumed for open pit and underground resources, respectively. A cut-off grade of 1.5 g/t gold was furthermore applied within a part of the Inferred Resource. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that any part of the Mineral Resources will be converted to Mineral Reserves.

Environmental Permits were granted in April and May 2020 for the Mestiza and America open pits respectively, both located close to La India. The Mestiza open pit hosts 92 Kt at a grade of 12.1 g/t gold (36,000 oz contained gold) in the Indicated Mineral Resource category and 341 Kt at a grade of 7.7 g/t gold (85,000 oz contained gold) in the Inferred Mineral Resource category. The America open pit hosts 114 Kt at a grade of 8.1 g/t gold (30,000 oz) in the Indicated Mineral Resource category and 677 Kt at a grade of 3.1 g/t gold (67,000 oz) in the Inferred Mineral Resource category. Following the permitting of the Mestiza and America open pits, together with the La India open pit Condor has 1.12 M oz gold open pit Mineral Resources permitted for extraction.

Disclaimer

Neither the contents of the Company’s website nor the contents of any website accessible from hyperlinks on the Company’s website (or any other website) is incorporated into, or forms part of, this announcement.

Qualified Persons

The Mineral Resource Estimate has been completed by Ben Parsons, a Principal Consultant (Resource Geology) with SRK Consulting (U.S.) Inc, who is a Member of the Australian Institute of Mining and Metallurgy, MAusIMM(CP). He has some nineteen years’ experience in the exploration, definition and mining of precious and base metals. Ben Parsons is a full-time employee of SRK Consulting (U.S.), Inc, an independent consultancy, and has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration, and to the type of activity which he is undertaking to qualify as a “qualified person” as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) of the Canadian Securities Administrators and as required by the June 2009 Edition of the AIM Note for Mining and Oil & Gas Companies. Ben Parsons consents to the inclusion in the announcement of the matters based on their information in the form and context in which it appears and confirms that this information is accurate and not false or misleading.

The Qualified Persons responsible for the Technical Report are Dr Tim Lucks of SRK Consulting (UK) Limited, and Mr Fernando Rodrigues, Mr Stephen Taylor and Mr Ben Parsons of SRK Consulting (U.S.) Inc. Mr Parsons assumes responsibility for the MRE, Mr Rodrigues the open pit mining aspects, Mr Taylor the underground mining aspects and Dr Lucks for the oversight of the remaining technical disciplines and compilation of the report.

The technical and scientific information in this press release has been reviewed, verified and approved by Gerald D. Crawford, P.E., who is a “qualified person” as defined by NI 43-101 and is the Chief Technical Officer of Condor Gold plc.

The technical and scientific information in this press release has been reviewed, verified and approved by Andrew Cheatle, P.Geo., who is a “qualified person” as defined by NI 43-101.

Forward Looking Statements

All statements in this press release, other than statements of historical fact, are ‘forward-looking information’ with respect to the Company within the meaning of applicable securities laws, including statements with respect to: the ongoing mining dilution and pit optimisation studies, and the incorporation of same into any mining production schedule, future development and production plans at La India Project. Forward-looking information is often, but not always, identified by the use of words such as: "seek", "anticipate", "plan", "continue", “strategies”, “estimate”, "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", “could”, “might”, “will” and similar expressions. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions regarding: future commodity prices and royalty regimes; availability of skilled labour; timing and amount of capital expenditures; future currency exchange and interest rates; the impact of increasing competition; general conditions in economic and financial markets; availability of drilling and related equipment; effects of regulation by governmental agencies; the receipt of required permits; royalty rates; future tax rates; future operating costs; availability of future sources of funding; ability to obtain financing and assumptions underlying estimates related to adjusted funds from operations. Many assumptions are based on factors and events that are not within the control of the Company and there is no assurance they will prove to be correct.

Such forward-looking information involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to: mineral exploration, development and operating risks; estimation of mineralisation and resources; environmental, health and safety regulations of the resource industry; competitive conditions; operational risks; liquidity and financing risks; funding risk; exploration costs; uninsurable risks; conflicts of interest; risks of operating in Nicaragua; government policy changes; ownership risks; permitting and licencing risks; artisanal miners and community relations; difficulty in enforcement of judgments; market conditions; stress in the global economy; current global financial condition; exchange rate and currency risks; commodity prices; reliance on key personnel; dilution risk; payment of dividends; as well as those factors discussed under the heading “Risk Factors” in the Company’s annual information form for the fiscal year ended December 31, 2020 dated March 31, 2021 and available under the Company’s SEDAR profile at www.sedar.com.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()