Will the price of silver continue to rise, or will there be a correction?

Breaking News:

Kathmandu Nepal

Donnerstag, Jan. 29, 2026

Advertisement/Advertising – This article is distributed on behalf of Vizsla Silver Corp., Vizsla Royalties Corp. and Osisko Development Corp., with whom SRC swiss resource capital AG has paid IR consulting agreements. Creator: SRC swiss resource capital AG · Author: Ingrid Heinritzi · First published: January 29, 2026, 2:30 p.m. Zurich/Berlin

According to some voices, the extremely dynamic movement of the silver price could come to an abrupt end. But from a technical chart perspective, there are no signs of a reversal. The upward trend remains intact, and technical chart signals confirm this. The price of silver therefore appears to be continuing its upward trajectory. Only if the price were to fall below important marks such as US$97 or US$90 per ounce would a major correction be possible. Overall, the price of the precious metal has more than quadrupled in the past two years. The increase is thus greater than the increase in the price of gold.

The gold-silver ratio is now only around 46. In recent years, the ratio has mostly been around 80 or 90. The gold-silver ratio indicates how many ounces of silver are needed to equal the value of one ounce of gold. If the ratio is rather low, as it is now, gold is considered relatively cheaper. Short-term corrections in the silver price are possible, as the high price may lead to profit-taking. In any case, silver is benefiting from rising demand and low availability.

The RSI (relative strength index) is an indicator from technical analysis that measures the extent of recent price changes. Currently, the RSI indicates that the market is overheated. This could argue for a short-term correction in the price of silver. However, silver is now also considered a safe haven and is likely to benefit from uncertainties. There are plenty of these, such as the recent possibility of another US government shutdown. The future does not look bad for silver and gold.

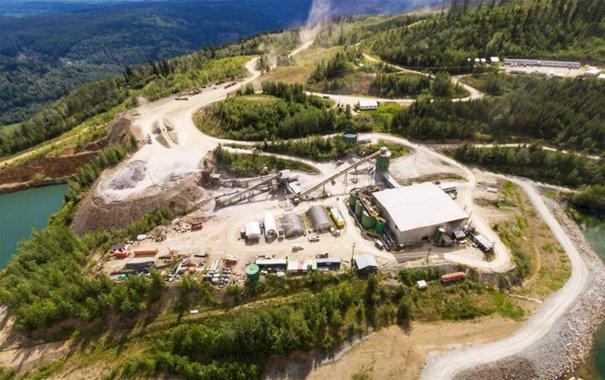

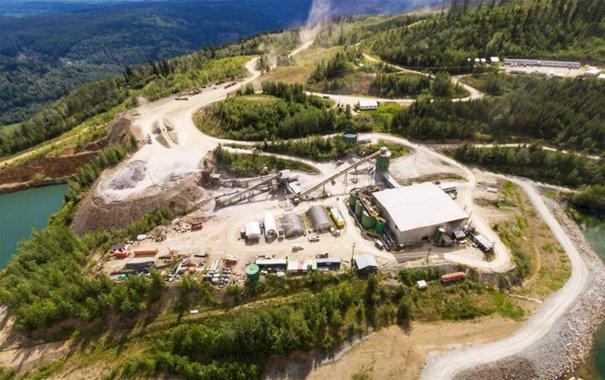

Osisko Development – https://www.commodity-tv.com/ondemand/companies/profil/osisko-development-corp/ – owns, among other things, the flagship Cariboo Gold project (Canada, 100 percent). Production at Cariboo (approximately 190,000 ounces of gold per year over ten years) is scheduled to start in 2027. A 70,000-meter drilling program is underway at Cariboo to investigate potential resource growth.

Vizsla Royalties – https://www.commodity-tv.com/ondemand/companies/profil/vizsla-royalties-corp/ – is a royalty company offering corporate diversification and owns two NSR royalties. One is a 2% interest in the Panuco property in Mexico, which is a primary, high-grade silver resource. The other is a 3.5% interest in the Silverstone concessions.

Vizsla Silver – https://www.commodity-tv.com/ondemand/companies/profil/vizsla-silver-corp/ – owns the formerly producing Panuco gold-silver project in Mexico. Annual production of 15.2 million ounces of silver equivalent is expected. The feasibility study has been very positive.

Current company information and press releases from Osisko Development (- https://www.resource-capital.ch/en/companies/osisko-development-corp/ -) and

Vizsla Royalties (- https://www.resource-capital.ch/en/companies/mag-silver-corp/ -) and Vizsla Silver (- https://www.resource-capital.ch/en/companies/vizsla-silver-corp/ -).

Further information is also available in our new precious metals report at the following link: https://www.resource-capital.ch/en/reports/view/precious-metals-report-2025-11-update/

Sources: https://www.goldpreis.de/gold-silber-ratio/;

https://www.finanzen.net/ratgeber/trading/grundlagen-einstieg/relative-strength-index/;

https://www.resource-capital.ch/en/reports/view/precious-metals-report-2025-11-update/

In accordance with Section 85 of the German Securities Trading Act (WpHG) in conjunction with Article 20 of Regulation (EU) 2016/958 (MAR), we hereby disclose that authors/employees/affiliated companies of SRC swiss resource capital AG may hold positions (long/short) in issuers discussed. Remuneration/relationship: IR contracts/advertorial: Own positions (author): none; SRC net position: less than 0.5%; issuer’s stake in SRC ≥ 5%: no. Update policy: no obligation to update. No guarantee for the translation into German. Only the English version of this news release is authoritative.

Disclaimer: The information provided does not constitute any form of recommendation or advice. We expressly draw attention to the risks involved in securities trading. No liability can be accepted for any damage arising from the use of this blog. We would like to point out that shares and, in particular, warrant investments are generally associated with risk. The total loss of the capital invested cannot be ruled out. All information and sources are carefully researched. However, no guarantee is given for the accuracy of all content. Despite the utmost care, I expressly reserve the right to errors, particularly with regard to figures and prices. The information contained herein comes from sources that are considered reliable, but does not claim to be accurate or complete. Due to court rulings, the content of linked external sites is also our responsibility (e.g., Hamburg Regional Court, in its ruling of May 12, 1998 – 312 O 85/98), as long as we do not expressly distance ourselves from them. Despite careful content control, I assume no liability for the content of linked external sites. The respective operators are solely responsible for their content. The disclaimer of SRC swiss resource capital AG, which is available at https://www.resource-capital.ch/de/disclaimer-agb/, applies additionally.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()