2026 Global Wall Decor Market Report: Technology Shifts, Demand Dynamics & Investment Outlook

Breaking News:

Durchbruch in der Peptidentwicklung? LIR Life Sciences setzt Innovations-Roadmap fort

Nächste Generation Peptide: LIR und Neuland Laboratories beschleunigen Entwicklung

Mundgeruch effektiv bekämpfen – mit moderner Ultraschalltechnologie

Sichern Sie sich jetzt passende Domains zur Fußball WM und EM

Ski-Domain ist die Adresse erster Wahl zu den Olympischen Winterspielen

Kathmandu Nepal

Sonntag, Feb. 8, 2026

Growth remains structurally sound as homeowners, businesses, and hospitality operators invest in visual upgrades that enhance ambience without major structural renovation. Framed artwork, mirrors, murals, wall panels, and decals are widely favored for their ease of installation, affordability, and immediate visual impact. Residential buyers lean toward framed prints and decorative mirrors, while offices, hotels, and retail spaces increasingly adopt murals and textured wall panels to create immersive environments.

Get Exclusive Access To Data Tables, Market Sizing Dashboards, And Analyst Insights. Request Sample Report!

Home renovation and remodeling activity remains a primary demand driver, especially in urban housing markets where space optimization and interior upgrades are prioritized over new construction. Social media influence and digital inspiration platforms further accelerate replacement cycles, encouraging frequent refreshes in wall aesthetics. As personalization becomes central to interior design decisions, wall decor continues to benefit from strong emotional and functional relevance.

Retail dynamics are also reshaping market performance. Online home décor platforms expand consumer access to global design styles, regional artwork, and customizable solutions, driving higher purchase frequency. At the same time, specialty décor stores and home furnishing outlets maintain importance by offering curated displays and tactile evaluation, particularly for premium and oversized items.

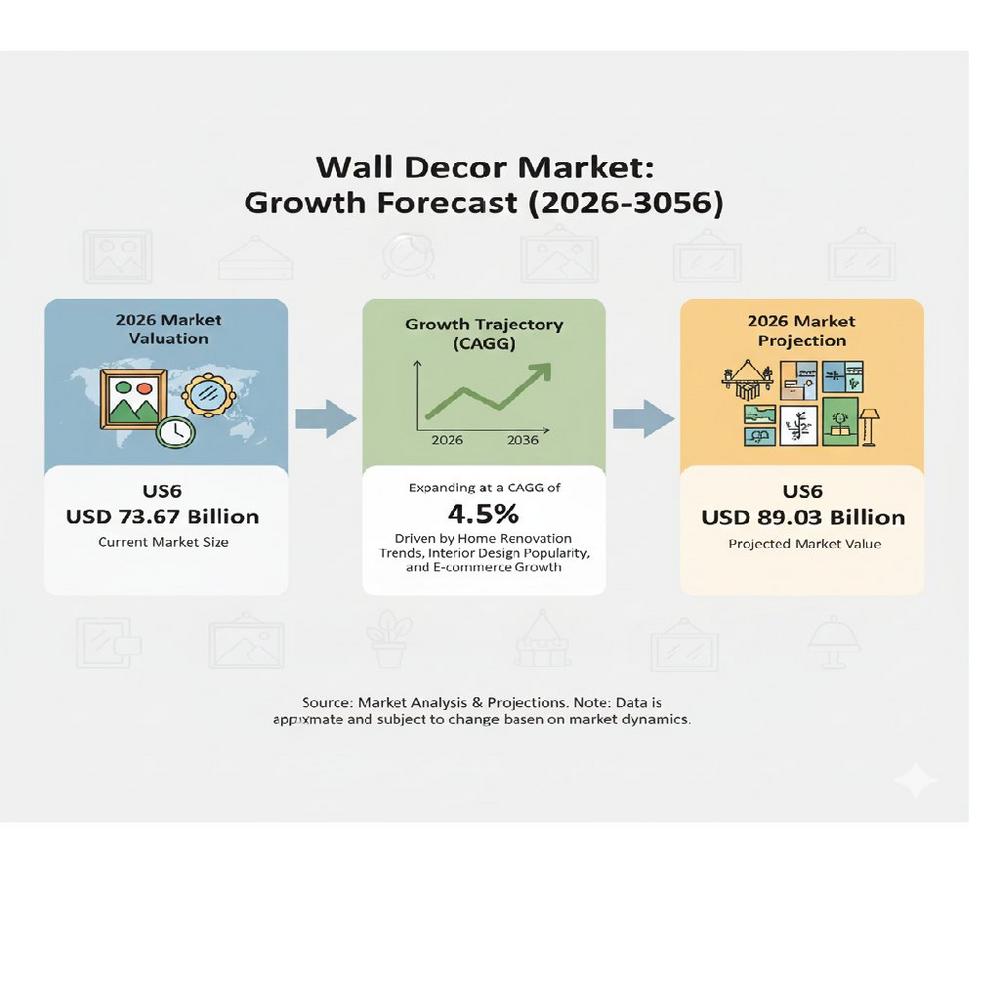

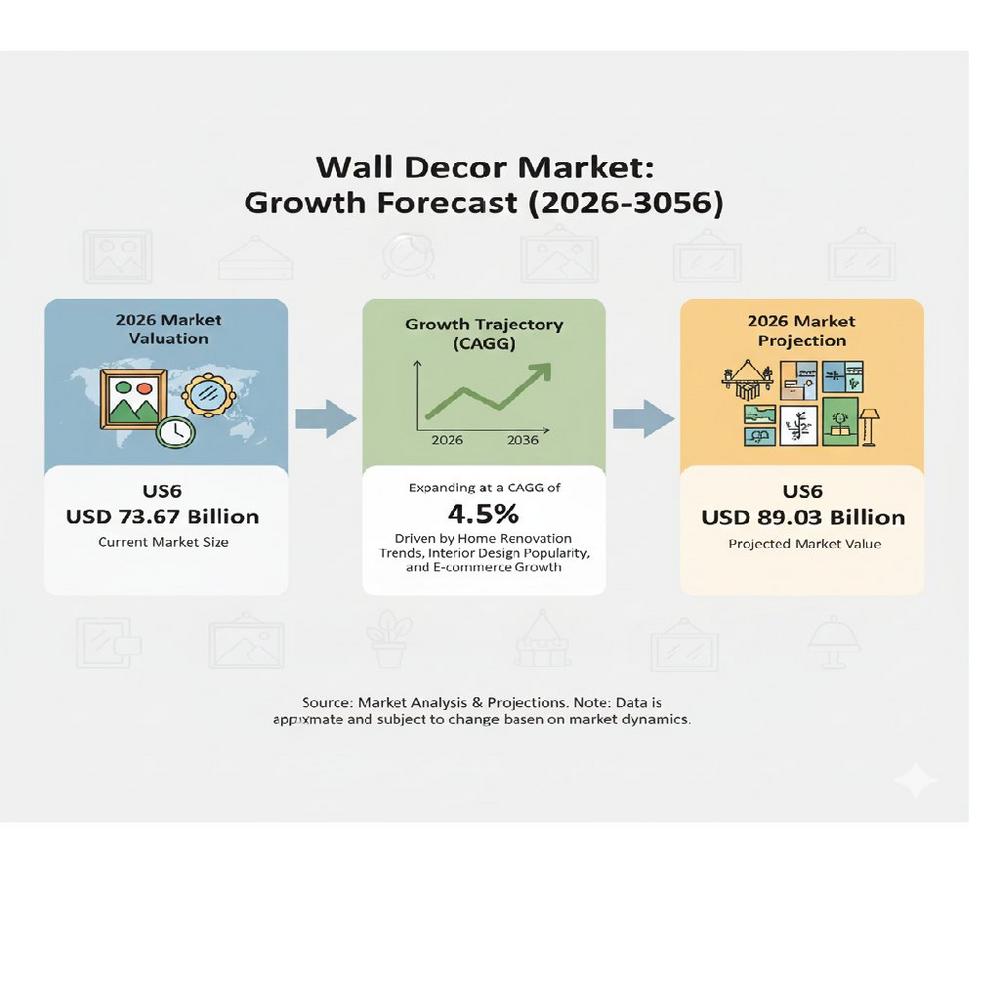

Market Snapshot: Wall Decor Industry Outlook (2026–2036)

Wall Art Dominates Global Product Demand

Wall art represents approximately 38% of global wall decor demand, making it the largest product segment. Its leadership is driven by versatility, broad price accessibility, and suitability across residential and commercial interiors. Framed prints, canvas art, posters, and decorative panels allow consumers to personalize spaces without permanent changes.

Online platforms significantly strengthen this segment by enabling customization, artist-led collections, and quick design discovery. Frequent trend refreshes and strong social media influence support repeat purchasing behavior, reinforcing wall art’s dominance across both mature and emerging markets.

Offline Channels Retain Sales Leadership

Despite rapid digital growth, offline retail channels account for around 55% of total wall decor sales globally. Physical stores remain relevant as buyers prefer to assess size, texture, finish, and color accuracy before purchasing decorative items. Specialty décor stores and home furnishing outlets benefit from in-store visualization, impulse buying, and premium product discovery.

While online platforms continue to narrow the gap through augmented previews and broader assortments, offline retail maintains leadership due to trust, immediate availability, and tactile product evaluation.

Regional Growth Patterns Remain Balanced

North America and Europe represent mature demand centers supported by stable replacement cycles and strong renovation activity. Asia Pacific continues to emerge as the fastest-growing region, driven by rising urban populations, higher disposable incomes, and growing interest in modern home aesthetics among younger consumers.

Country-level data highlights varied growth dynamics:

Design Trends and Consumer Preferences Shape Adoption

Consumer preferences increasingly favor easy-to-install, removable, and customizable wall decor solutions. Peel-and-stick wallpapers, modular wall art, and lightweight panels appeal to renters and younger buyers seeking flexibility. Minimalist themes, abstract visuals, and nature-inspired designs remain popular across living rooms, bedrooms, and workspaces.

Digital visualization tools and augmented previews improve buyer confidence, reducing hesitation and returns while supporting higher online conversion rates.

Operational Challenges and Scalability Considerations

Market scalability is influenced by raw material pricing, logistics costs, and production efficiency. Wood, metal, glass, and specialty finishes face price volatility, impacting margins for premium offerings. Transportation complexity for large or fragile items further adds cost pressure. Long-term growth depends on efficient sourcing, streamlined manufacturing, and the ability to balance design innovation with cost control.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates

Competitive Landscape Remains Intense

The wall decor market is highly competitive, featuring global brands, home improvement retailers, digital-first platforms, and independent designers. Established players such as IKEA, Home Depot, Lowe’s, Wayfair, and Williams-Sonoma maintain strong positions through extensive portfolios, omnichannel reach, and pricing depth.

E-commerce-driven platforms and artist marketplaces continue to reshape competition by emphasizing personalization, limited-edition designs, and visual discovery. Mid-sized and niche brands compete through craftsmanship, natural materials, and curated aesthetics tailored to premium buyers.

As interior personalization becomes a long-term lifestyle trend rather than a short-term upgrade, the wall decor market is positioned for steady, design-led growth through 2036, supported by innovation, retail evolution, and expanding global urban lifestyles.

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Future Market Insights, Inc

Christiana Corporate, 200 Continental Drive, Suite 401,

USADelaware Newark,

Telefon: +1-347-918-3531

Telefax: +1 845 5795705

http://www.futuremarketinsights.com

![]()