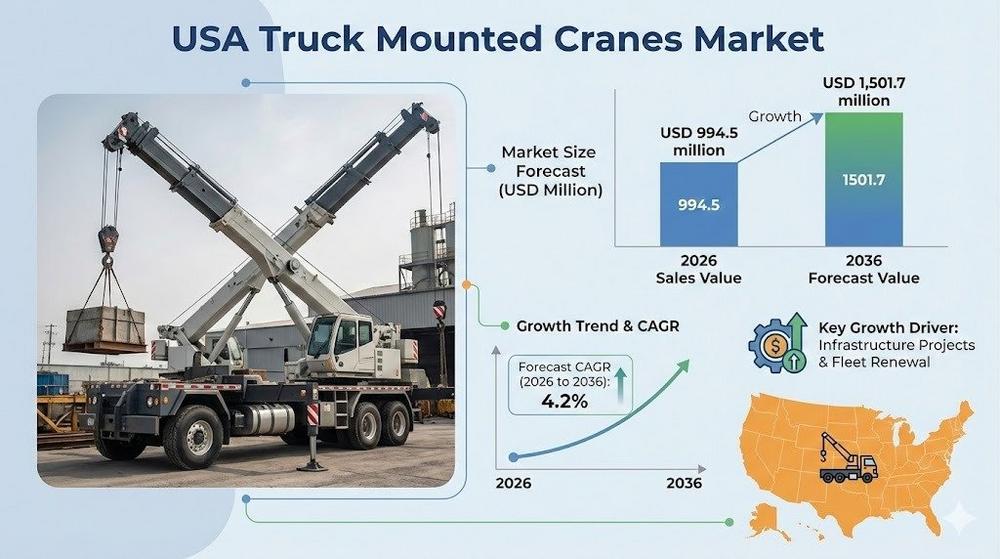

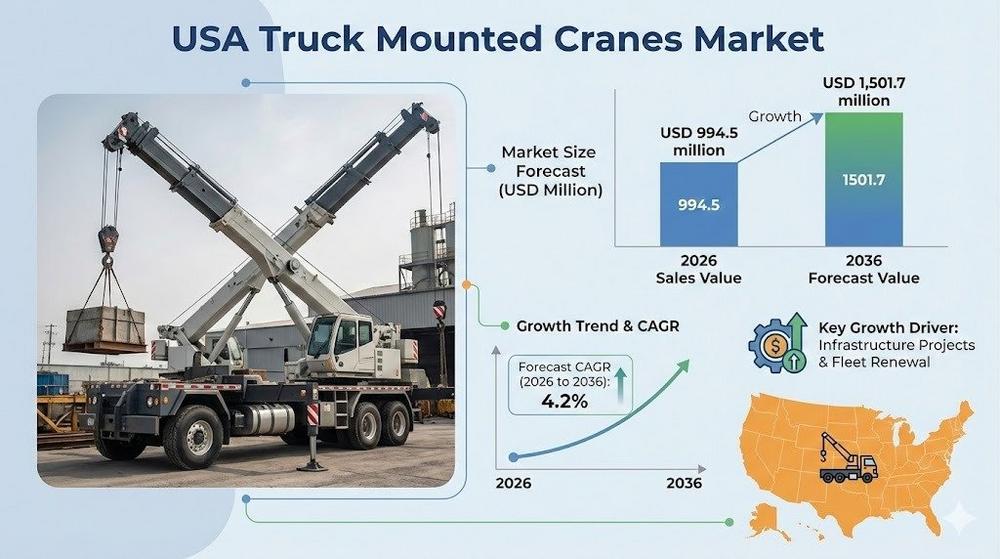

USA Truck Mounted Cranes Demand Accelerates with Infrastructure and Utility Expansion Through 2036

Breaking News:

Kathmandu Nepal

Montag, Feb. 2, 2026

Truck mounted cranes are increasingly favored across construction, municipal services, utilities, and energy operations due to their ability to combine transportation and lifting in a single platform. Their rapid setup, road mobility, and reduced site downtime make them an efficient alternative to stationary and heavy all-terrain cranes, particularly for dispersed and time-sensitive job sites.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates https://www.futuremarketinsights.com/reports/sample/rep-gb-29916

Key market indicators include:

Infrastructure, Utilities, and Energy Projects Anchor Core Demand

The primary drivers of demand for truck mounted cranes in the USA are public infrastructure rehabilitation, utility network upgrades, and energy sector maintenance. Federal and state programs focused on highways, bridges, ports, transit systems, and public facilities are sustaining consistent procurement of mobile lifting equipment.

Utility companies deploy truck mounted cranes extensively for:

Energy-related applications further reinforce demand. Oil and gas service providers rely on truck mounted cranes for equipment handling across remote sites, while renewable energy projects require mobile lifting solutions for installation and ongoing maintenance. Rental fleets continue expanding inventories to support short-term and multi-sector project requirements.

Stiff Boom Cranes Dominate Product-Type Demand

By product type, stiff boom cranes account for 60.0% of total USA demand, making them the dominant segment. Their straight, rigid boom design offers higher structural stability, predictable load control, and lifting precision, which are essential for frequent, short-cycle operations common in construction and utility work.

Stiff boom cranes are widely used for:

Technological improvements in hydraulic controls, load-moment indicators, and chassis integration continue to enhance safety and operational efficiency. Knuckle boom cranes, holding 40.0% share, serve space-constrained urban applications where articulated movement and precise placement are required, but stiff boom models remain the preferred choice for heavy-duty lifting across the USA.

Product-type highlights:

Hydraulic Drive Systems Lead Fleet Adoption

By drive type, hydraulic systems represent 50.0% of USA demand, reflecting their reliability, high power density, and smooth load handling performance. Hydraulic drives integrate efficiently with truck power take-off systems, making them the standard choice across construction, utility, and rental fleets.

Electrical drive systems account for 35.0% of demand, driven by increasing interest in quieter operation and alignment with electrification and sustainability goals, particularly in urban and municipal settings. Mechanical drives, at 15.0%, remain relevant mainly in legacy applications requiring simpler control mechanisms.

Drive-type demand trends include:

Regional Demand Reflects Infrastructure Intensity Across the USA

Demand growth varies across regions based on infrastructure age, construction activity, and utility investment levels.

Get data that aligns with your strategic priorities — ask for report customization today: https://www.futuremarketinsights.com/customization-available/rep-gb-29916

Competitive Landscape Focuses on Performance and Service Support

The competitive environment in the USA truck mounted cranes market is anchored by established manufacturers with strong domestic support capabilities. Key players include Manitex International, Terex Utilities, Palfinger USA, National Crane, and Elliott Equipment Company.

Procurement decisions increasingly prioritize:

As infrastructure spending, utility upgrades, and energy projects continue, demand for truck mounted cranes in the USA is expected to remain resilient through 2036, supported by the market’s need for efficient, mobile, and versatile lifting solutions across critical industries.

Have a specific Requirements and Need Assistant on Report Pricing or Limited Budget please contact us – sales@futuremarketinsights.com

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Future Market Insights, Inc

Christiana Corporate, 200 Continental Drive, Suite 401,

USADelaware Newark,

Telefon: +1-347-918-3531

Telefax: +1 845 5795705

http://www.futuremarketinsights.com

![]()