Fortuna drills 4.5 g/t Au over 37.4 meters at Kingfisher and 11.2 g/t Au over 5.6 meters at Sunbird, Séguéla Mine, Côte d’Ivoire

Breaking News:

Kathmandu Nepal

Montag, Jan. 12, 2026

Paul Weedon, Senior Vice President of Exploration at Fortuna, commented, “A successful infill drill program was completed at Kingfisher, with several notable intersections confirming the broad nature of the mineralization, including 4.5 g/t Au over an estimated true width of 37.4 meters from 79 meters in drill hole SGRD2363. Exploration has now turned to further extending the strike and depth at Kingfisher, successfully intersecting mineralization 300 meters below surface and a further 250 meters along strike.”

Mr. Weedon continued “Deep exploration drilling testing the southern extent of Sunbird has continued to return excellent results while upgrading the geological confidence and expanding the mineralized envelope, with results including 8.5 g/t Au over an estimated true width of 7.0 meters from 566 meters in drill hole SGRD2431. In addition, drilling has recently identified near surface shallow mineralization approximately 180 meters into the footwall, with results including 2.1 g/t over an estimated true width of 8.4 meters from 32 meters in drill hole SGRD2418 and 5.6 g/t Au over an estimated true width of 4.9 meters from 98 meters in drill hole SGRD2422. Mineralization remains open at depth and along strike.”

Kingfisher Deposit Drilling Highlights

SGRD2313:

9.4 g/t Au over an estimated true width of 17.0 meters from 105 meters, including

58.1 g/t Au over an estimated true width of 0.9 meters from 118 meters, and

36.2 g/t Au over an estimated true width of 2.6 meters from 121 meters

2.1 g/t Au over an estimated true width of 13.6 meters from 131 meters, including

12.1 g/t Au over an estimated true width of 0.9 meters from 138 meters

SGRD2349:

5.6 g/t Au over an estimated true width of 22.1 meters from 83 meters, including

63.1 g/t Au over an estimated true width of 0.9 meters from 94 meters, and

14.1 g/t Au over an estimated true width of 2.6 meters from 101 meters

2.4 g/t Au over an estimated true width of 18.7 meters from 113 meters, including

30.2 g/t Au over an estimated true width of 0.9 meters from 115 meters

SGRD2363:

4.5 g/t Au over an estimated true width of 37.4 meters from 79 meters, including

28.4 g/t Au over an estimated true width of 0.9 meters from 103 meters, and

26.1 g/t Au over an estimated true width of 2.6 meters from 107 meters, and

12.3 g/t Au over an estimated true width of 0.9 meters from 122 meters

SGRD2366:

4.4 g/t Au over an estimated true width of 20.4 meters from 28 meters, including

48.9 g/t Au over an estimated true width of 0.9 meters from 48 meters

SGRD2367:

4.0 g/t Au over an estimated true width of 6.8 meters from 53 meters

3.7 g/t Au over an estimated true width of 23.8 meters from 72 meters, including

28.2 g/t Au over an estimated true width of 1.7 meters from 97 meters

SGRD2370:

3.0 g/t Au over an estimated true width of 31.5 meters from 127 meters, including

15.6 g/t Au over an estimated true width of 0.9 meters from 133 meters, and

33.5 g/t Au over an estimated true width of 0.9 meters from 150 meters, and

15.2 g/t Au over an estimated true width of 0.9 meters from 159 meters,

SGRD2381:

4.2 g/t Au over an estimated true width of 26.4 meters from 36 meters, including

14.0 g/t Au over an estimated true width of 0.9 meters from 47 meters, and

11.4 g/t Au over an estimated true width of 0.9 meters from 52 meters, and

15.1 g/t Au over an estimated true width of 1.7 meters from 61 meters

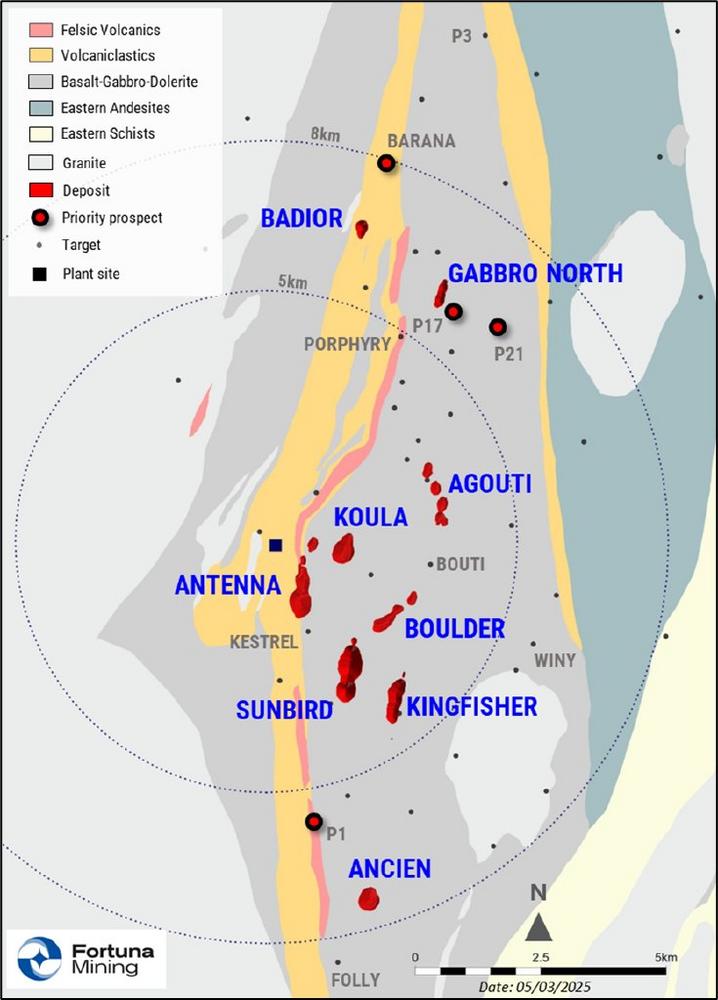

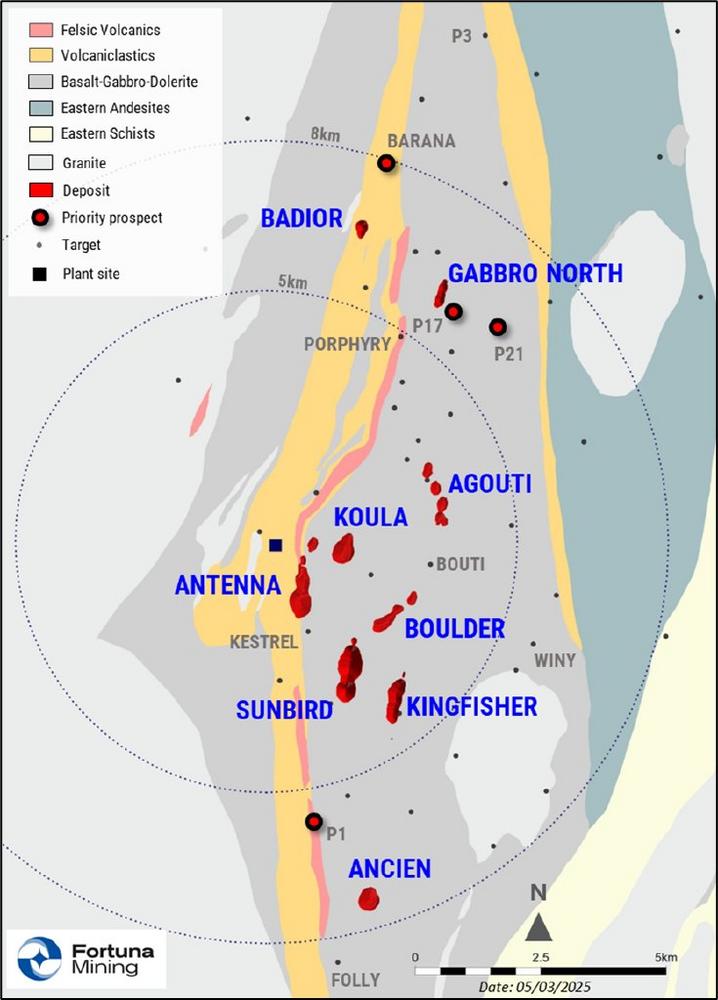

An additional 78 drill holes, totaling 13,262 meters, have been completed at the Kingfisher Deposit (refer to Figure 1) as part of the resource confidence infill and extension drill program (refer to Figure 2). Drilling to test the emerging down-plunge potential to the north is advancing with two drill rigs in operation. Highlights include drill hole SGRD2501, which intersected 12.7 g/t Au over an estimated true width of 0.9 meters as part of a wider interval of 1.6 g/t Au over an estimated true width of 9.4 meters from 362 meters depth, approximately 300 meters vertically. This is the deepest drilling to date at Kingfisher, with mineralization remaining open along strike and at depth along a greater than one kilometer strike. Drilling is planned to continue through 2025.

The apparent moderate northerly plunge interpreted for the Kingfisher mineralization is atypical for Séguéla, where a moderate southerly plunge is more common. This variation is interpreted as being related to localized dextral movement along the main shear corridor.

Sunbird Deposit Drilling Highlights

SGRD2219:

3.0 g/t Au over an estimated true width of 4.2 meters from 410 meters

12.2 g/t Au over an estimated true width of 4.9 meters from 420 meters, including

37.8 g/t Au over an estimated true width of 1.4 meters from 425 meters

SGRD2406:

25.2 g/t Au over an estimated true width of 2.1 meters from 360 meters

SGRD2407:

9.1 g/t Au over an estimated true width of 5.6 meters from 196 meters, including

52.5 g/t Au over an estimated true width of 0.7 meters from 199 meters

SGRD2409:

11.2 g/t Au over an estimated true width of 5.6 meters from 479 meters, including

24.6 g/t Au over an estimated true width of 2.1 meters from 480 meters

SGRD2427:

4.1 g/t Au over an estimated true width of 4.2 meters from 472 meters

10.4 g/t Au over an estimated true width of 4.9 meters from 483 meters

SGRD2431:

8.5 g/t Au over an estimated true width of 7.0 meters from 566 meters, including

53.3 g/t Au over an estimated true width of 0.7 meters from 566 meters

6.6 g/t Au over an estimated true width of 2.8 meters from 591 meters, including

21.1 g/t Au over an estimated true width of 0.7 meters from 591 meters

SGRD2433:

13.1 g/t Au over an estimated true width of 3.5 meters from 472 meters, including

26.8 g/t Au over an estimated true width of 0.7 meters from 473 meters, and

23.2 g/t Au over an estimated true width of 0.7 meters from 476 meters

7.1 g/t Au over an estimated true width of 7.7 meters from 482 meters, including

10.4 g/t Au over an estimated true width of 0.7 meters from 482 meters, and

18.2 g/t Au over an estimated true width of 0.7 meters from 484 meters, and

21.1 g/t Au over an estimated true width of 0.7 meters from 487 meters

An additional 41 drill holes, totaling 17,532 meters, have been completed at the Sunbird Deposit (refer to Figure 1) as part of the resource confidence infill and extension program (refer to Figure 3). The program had two objectives: first, to infill and upgrade resource confidence for an approximate 600-meter section along strike of the current underground resource; and second, to extend and expand the down-plunge extension a further 300 meters south.

Drilling on the main shoot has continued to intersect high grades along the projected plunge, with drill-defined mineralization now extending more than 1.1 kilometers down plunge, approximately 700 meters below surface. Results include 11.2 g/t Au over an estimated true width of 5.6 meters from 479 meters in drill hole SGRD2409. Results such as 10.4 g/t Au over an estimated true width of 4.9 meters from 483 meters in drill hole SGRD2427, and 12.2 g/t Au over an estimate true width of 4.9 meters from 420 meters in drill hole SGRD2219, highlight the emergence of a second high grade shoot extending at least 800 meters down plunge from the bottom of the currently defined pit. Mineralization remains open at depth and along strike, with drilling scheduled to continue until the end of 2025.

Drilling targeting the deep extensions also intersected near-surface mineralization approximately 180 meters into the footwall. Further drilling will be carried out to determine the mineralized extent, which is presently open over a 400-meter strike length, and relationship to Sunbird as well as historic small-scale artisanal workings further south along strike. Results include 5.6 g/t Au over an estimated true width of 4.9 meters from 98 meters in drill hole SGRD2422, and 14.7 g/t Au over an estimated true width of 2.8 meters from 32 meters in drill hole SGRD2218.

Quality Assurance & Quality Control (QA – QC)

All drilling was completed under supervision of Fortuna personnel, following standardized procedures and methodologies.

Reverse Circulation (RC) Drilling

RC drilling used a 5.25-inch face sampling pneumatic hammer, with samples collected into 60-liter plastic bags. Samples were kept dry by maintaining sufficient air pressure to exclude groundwater inflow. If water ingress exceeded the air pressure, RC drilling was stopped, and drilling converted to diamond core tails. Once collected, RC samples were riffle split through a three-tier splitter to produce a 12.5% representative sample for laboratory submission. The remaining 87.5% samples were stored at the drill site until assay results were received and validated. Coarse reject samples from mineralized samples corresponding to significant intervals are retained and stored on-site at the Company´s core yard.

Diamond Drilling (DD)

DD drill holes started with HQ sized diameter, before reducing to NQ diameter diamond drill bits on intersecting fresh rock. The core was logged, marked for sampling in standard one-meter lengths or to a geological boundary, then cut into equal halves using a diamond saw. One half was retained in the original core box and stored in a secure location at the Company core yard at the project site. The other half was sampled, catalogued, and placed into sealed bags and securely stored at the site until shipment.

Sample Transport and Analysis

All RC and DD samples were transported by Company vehicle or commercial courier to ALS Global’s preparation laboratory in Yamoussoukro, Cote d’Ivoire or Bureau Veritas’ preparation and analytical laboratory in Abidjan, Cote d’Ivoire. Sample pulps prepared by ALS Global were then transported via commercial courier to ALS Global’s facility in Ouagadougou, Burkina Faso. Routine gold analysis using a 50-gram charge and fire assay with an atomic absorption finish was completed for all samples at either ALS’s Ouagadougou laboratory or Bureau Veritas’ laboratory in Abidjan. Samples returning assays >10 ppm Au were reanalyzed using a 50-gram charge and fire assay with a gravimetric finish.

Quality Control

Quality control procedures included systematic insertion of blanks, duplicates, and certified reference standards into the sample stream. Both ALS Global and Bureau Veritas laboratories also inserted their own quality control samples.

Qualified Person

Paul Weedon, Senior Vice President Exploration for Fortuna Mining Corp., is a Qualified Person as defined by National Instrument 43-101 being a member of the Australian Institute of Geoscientists (Membership #6001). Mr. Weedon has reviewed and approved the scientific and technical information contained in this news release. He has also verified the data disclosed, including the sampling, analytical and test data underlying the information or opinions contained herein, by reviewing geochemical and geological databases and examining diamond drill core. There were no limitations to the verification process.

About Fortuna Mining Corp.

Fortuna Mining Corp. is a Canadian precious metals mining company with three operating mines and a portfolio of exploration projects in Argentina, Côte d’Ivoire, Mexico, and Peru, as well as the Diamba Sud Gold Project in Senegal. Sustainability is at the core of our operations and stakeholder relationships. We produce gold and silver while creating long-term shared value through efficient production, environmental stewardship, and social responsibility. For more information, please visit our website at www.fortunamining.com

Forward looking Statements

This news release contains forward-looking statements which constitute “forward-looking information” within the meaning of applicable Canadian securities legislation and “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 (collectively, “Forward-looking Statements”). All statements included herein, other than statements of historical fact, are Forward-looking Statements and are subject to a variety of known and unknown risks and uncertainties which could cause actual events or results to differ materially from those reflected in the Forward-looking Statements. The Forward-looking Statements in this news release may include, without limitation, the Company’s proposed exploration plans at the Séguéla Mine ; statements about the Company’s business strategies, plans and outlook; the Company’s plans for its mines and mineral properties; changes in general economic conditions and financial markets; the impact of inflationary pressures on the Company’s business and operations; the future results of exploration activities; expectations with respect to metal grade estimates and the impact of any variations relative to metals grades experienced; assumed and future metal prices; the merit of the Company’s mines and mineral properties; and the future financial or operating performance of the Company. Often, but not always, these Forward-looking Statements can be identified by the use of words such as “estimated”, “potential”, “open”, “future”, “assumed”, “projected”, “proposed”, “used”, “detailed”, “has been”, “gain”, “planned”, “reflecting”, “will”, “anticipated”, “estimated” “containing”, “remaining”, “to be”, or statements that events, “could” or “should” occur or be achieved and similar expressions, including negative variations.

Forward-looking Statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any results, performance or achievements expressed or implied by the Forward-looking Statements. Such uncertainties and factors include, among others, operational risks associated with mining and mineral processing; uncertainty relating to Mineral Resource and Mineral Reserve estimates; uncertainty relating to capital and operating costs, production schedules and economic returns; risks relating to the Company’s ability to replace its Mineral Reserves; risks related to the conversion of Mineral Resources to Mineral Reserves; risks associated with mineral exploration and project development; uncertainty relating to the repatriation of funds as a result of currency controls; environmental matters including obtaining or renewing environmental permits and potential liability claims; uncertainty relating to nature and climate conditions; laws and regulations regarding the protection of the environment (including greenhouse gas emission reduction and other decarbonization requirements and the uncertainty surrounding the interpretation of omnibus Bill C-59 and the related amendments to the Competition Act (Canada); risks associated with political instability and changes to the regulations governing the Company’s business operations; changes in national and local government legislation, taxation, controls, regulations and political or economic developments in countries in which the Company does or may carry on business; risks associated with war, hostilities or other conflicts, such as the Ukrainian – Russian, and Israeli – Hamas conflicts, and the impacts they may have on global economic activity; risks relating to the termination of the Company’s mining concessions in certain circumstances; developing and maintaining relationships with local communities and stakeholders; risks associated with losing control of public perception as a result of social media and other web-based applications; potential opposition to the Company’s exploration, development and operational activities; risks related to the Company’s ability to obtain adequate financing for planned exploration and development activities; property title matters; risks related to the ability to retain or extend title to the Company’s mineral properties; risks relating to the integration of businesses and assets acquired by the Company; impairments; risks associated with climate change legislation; reliance on key personnel; adequacy of insurance coverage; operational safety and security risks; legal proceedings and potential legal proceedings; uncertainties relating to general economic conditions; risks relating to a global pandemic, which could impact the Company’s business, operations, financial condition and share price; competition; fluctuations in metal prices; risks associated with entering into commodity forward and option contracts for base metals production; fluctuations in currency exchange rates and interest rates; tax audits and reassessments; risks related to hedging; uncertainty relating to concentrate treatment charges and transportation costs; sufficiency of monies allotted by the Company for land reclamation; risks associated with dependence upon information technology systems, which are subject to disruption, damage, failure and risks with implementation and integration; labor relations issues; as well as those factors discussed under “Risk Factors” in the Company’s Annual Information Form for the fiscal year ended December 31, 2024. Although the Company has attempted to identify important factors that could cause actual actions, events, or results to differ materially from those described in Forward-looking Statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking Statements contained herein are based on the assumptions, beliefs, expectations and opinions of management, including, but not limited to, the accuracy of the Company’s current Mineral Resource and Mineral Reserve estimates; that the Company’s activities will be conducted in accordance with the Company’s public statements and stated goals; that there will be no material adverse change affecting the Company, its properties or its production estimates (which assume accuracy of projected ore grade, mining rates, recovery timing, and recovery rate estimates and may be impacted by unscheduled maintenance, labor and contractor availability and other operating or technical difficulties); the duration and effect of global and local inflation; the duration and impacts of geo-political uncertainties on the Company’s production, workforce, business, operations and financial condition; the expected trends in mineral prices, inflation and currency exchange rates; that all required approvals and permits will be obtained for the Company’s business and operations on acceptable terms; that there will be no significant disruptions affecting the Company’s operations and such other assumptions as set out herein. Forward-looking Statements are made as of the date hereof and the Company disclaims any obligation to update any Forward-looking Statements, whether as a result of new information, future events, or results or otherwise, except as required by law. There can be no assurance that these Forward-looking Statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on Forward-looking Statements.

Cautionary Note to United States Investors Concerning Estimates of Reserves and Resources

All reserve and resource estimates included in this news release have been prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for public disclosure by a Canadian company of scientific and technical information concerning mineral projects. All Mineral Reserve and Mineral Resource estimates contained in the technical disclosure have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards on Mineral Resources and Reserves. Canadian standards, including NI 43-101, differ significantly from the requirements of the Securities and Exchange Commission, and mineral reserve and resource information included in this news release may not be comparable to similar information disclosed by U.S. companies.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()