Take advantage of temporary price setbacks in gold

Kathmandu Nepal

Dienstag, Feb. 3, 2026

The country wants to diversify its foreign exchange reserves by buying gold. Kenya currently has gold reserves of around 1.3 million US dollars, i.e. around 600 ounces of gold. The total foreign exchange reserves amount to around 9.6 billion US dollars. So far, gold has only made up a very small proportion of foreign currency assets. This could change. Kenya wants to reduce its dependence on the US dollar in favor of more gold reserves. This would give the country a better grip on currency fluctuations. This example shows the trend that will certainly affect even more central banks. This demand from central banks is of course good for the gold price.

Many agree that the current fall in the price of gold is likely to be short-lived before it starts to rise again. Investors should take advantage of the weak phase, for example by investing in well-positioned gold companies such as Revival Gold or Osisko Development.

Revival Gold – https://www.commodity-tv.com/ondemand/companies/profil/revival-gold-inc/ – is developing the Mercur gold project in Utah, which is ready for production in the relatively short term. The completion of the PEA doubles the company’s net asset value in gold. In addition, the company is preparing the permitting process and the ongoing exploration of the Beartrack-Arnett gold project in Idaho.

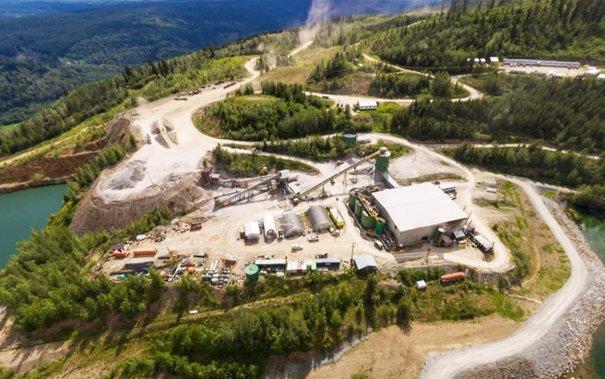

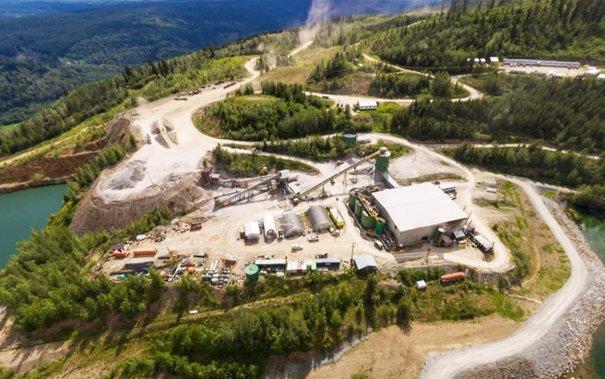

Osisko Development – https://www.commodity-tv.com/ondemand/companies/profil/osisko-development-corp/ – has gold in the Cariboo (Canada), San Antonio (Mexico) and Tintic (USA) projects. Production at Cariboo (around 190,000 ounces of gold per year over ten years) is scheduled to start in 2027.

Current company information and press releases from Osisko Development (– https://www.resource-capital.ch/en/companies/osisko-development-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()