First Tin Plc announces completion of Taronga drilling and assay Results

Breaking News:

Kathmandu Nepal

Montag, Feb. 9, 2026

The project is owned by First Tin’s 100% owned Australian subsidiary, Taronga Mines Pty Ltd (“TMPL”).

Highlights

All results are presented in Table 1. The true width of intervals is around half the downhole width. Estimated true widths are included in Table 1.

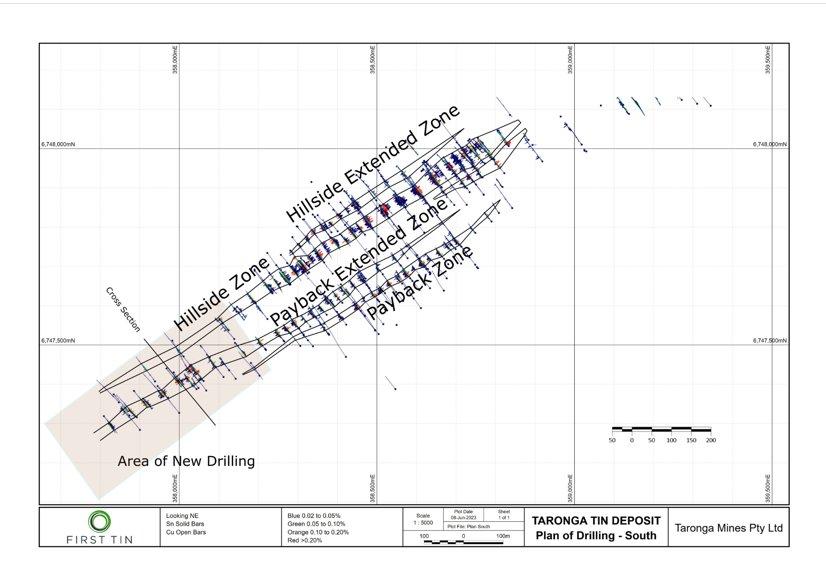

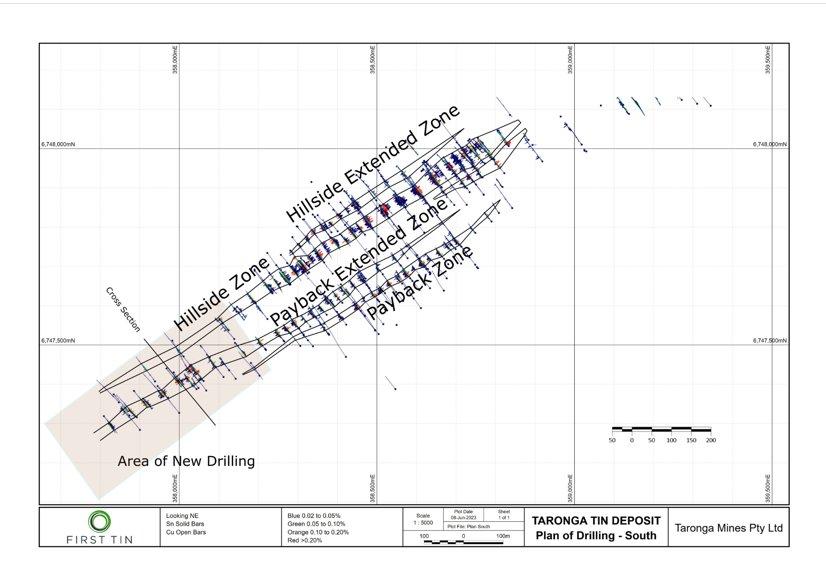

The southern extension drilling is significant as it has extended the mineralisation to the southwest by around 400m (Figure 1). A typical cross section is shown in Figure 2 and this shows the interpreted mineralisation zone, which is approximately 20m true width. This is about average for the 400m strike tested to date.

The southernmost line of drilling still returned significant mineralisation, indicating potential extensions still exist even further to the southwest.

A single line of drilling was put through the centre of the “gap” zone that sits between the north and south zones identified by Newmont. This returned three zones of mineralisation which are moderately mineralised with intercepts of:

These are shown on a cross section in Figure 4, the location of which is shown in Figure 3. We expect that these zones are extensions of the Payback and Payback Extended zones which trend into the north zone. They suggest good potential to close the gap between the two Newmont mineralisation zones so that a single pit may be possible. We expect to drill this area out in FY2024 as part of an optimisation programme.

Several drillholes were placed in the gaps in the previous drilling in order to improve the resource category in those areas. These were generally successful as shown by drillhole TMRC041 (Figures 5 and 3), which tested a weakly defined northwest extension to the mineralisation in the north zone. That hole returned 59m @ 0.12% Sn including 24m @ 0.16% Sn. This northwest extension also requires additional drilling that may increase resources. This is planned as part of the FY2024 optimisation programme.

First Tin CEO Thomas Buenger said: “The First Tin team in Taronga has made great progress over the past year and we are incredibly pleased to confirm that all drilling at our Taronga tin project in Australia is now complete and that the results from the programme have confirmed an approximately 400m extension to the southwest. This will be incorporated into a revised MRE, with results expected within Q3 2023.

The DFS continues at pace and the range of workstreams underway are progressing positively. We expect to undertake optimisation work at our Taronga asset, following the completion of the DFS, to confirm the final outline of the orebody. We look forward to next updating our shareholders as we continue to advance our world-class Taronga project further.”

Enquiries:

First Tin

Via SEC Newgate below

Thomas Buenger – Chief Executive Officer

Arlington Group Asset Management Limited (Financial Advisor and Joint Broker)

Simon Catt

+4420 7389 5016

WH Ireland Limited (Joint Broker)

Harry Ansell

+4420 7220 1670

SEC Newgate (Financial Communications)

Elisabeth Cowell / Molly Gretton

Swiss Resource Capital AG

Jochen Staiger

Notes to Editors

First Tin is an ethical, reliable, and sustainable tin production company led by a team of renowned tin specialists. The Company is focused on becoming a tin supplier in conflict-free, low political risk jurisdictions through the rapid development of high value, low capex tin assets in Germany and Australia.

Tin is a critical metal, vital in any plan to decarbonise and electrify the world, yet Europe has very little supply. Rising demand, together with shortages, is expected to lead tin to experience sustained deficit markets for the foreseeable future. Its assets have been de-risked significantly, with extensive work undertaken to date.

First Tin’s goal is to use best-in-class environmental standards to bring two tin mines into production in three years, providing provenance of supply to support the current global clean energy and technological revolutions.

APPENDIX 1

JORC Code, 2012 Edition – Table 1 Taronga Tin Project (TMPL)Section 1 Sampling Techniques and Data

(Criteria in this section apply to all succeeding sections.)

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()