75 to 100 US dollars for an ounce of silver in 2026

Breaking News:

Kathmandu Nepal

Donnerstag, Feb. 26, 2026

Advertisement/Advertising – This article is distributed on behalf of Vizsla Royalties Corp. and Endeavour Silver Corp., with which SRC swiss resource capital AG has paid IR advisory agreements. Creator: SRC swiss resource capital AG · Author: Ingrid Heinritzi · First published: January 5, 2026, 8:30 a.m. Zurich/Berlin

In terms of silver supply, production losses and low silver stocks are leading to significant deficits. Interest rate cuts in the US, a weakening US dollar, and speculative renewed demand for silver could boost the price. Renewable energies, the market for electric vehicles, and the proliferation of AI centers are also driving demand for silver. Among private investors, silver has become a mainstream investment alongside gold.

However, geopolitical tensions, which are known to drive up the price of gold, also affect the price of silver and turn silver into a safe haven. Silver is currently experiencing a boom. Of course, this leads to price fluctuations, but the big picture is what matters. Investors should not be unsettled by a price slump. And when the price of gold rises, the price of silver usually follows suit. One factor that should argue for rising gold prices and ultimately higher silver prices is the purchasing behavior of central banks. And in order to bring about a significant de-dollarization, many central banks still need to buy a great deal of gold.

Central banks are indeed accumulating more and more silver. Purchases of more than one billion ounces of silver have also been reported. India and Saudi Arabia, for example, have accumulated silver. This is giving rise to a new silver-based strategy. The exclusive dependence on gold is thus crumbling. The time has come to invest in silver and solid silver companies.

As a royalty company, Vizsla Royalties – https://www.commodity-tv.com/ondemand/companies/profil/vizsla-royalties-corp/ – offers corporate diversification and owns two NSR royalties. One is a 2% interest in the Panuco property in Mexico, which is a primary, high-grade silver resource. The other is a 3.5% interest in the Silverstone concessions.

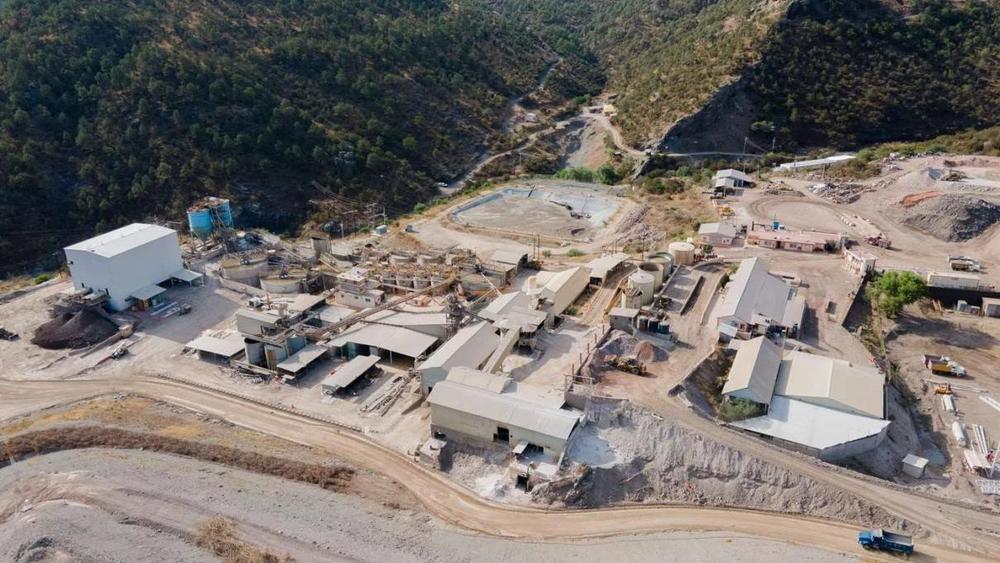

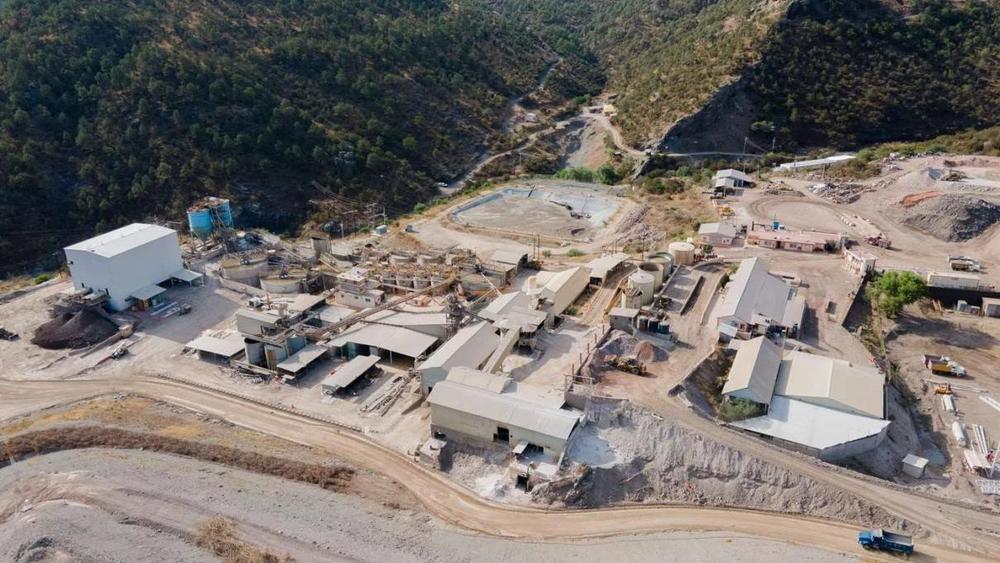

Endeavour Silver – https://www.commodity-tv.com/ondemand/companies/profil/endeavour-silver-corp/ – is one of the successful producers. The company’s projects are located in Mexico, Chile, and Peru. The third quarter of 2025 shines with an 88 percent increase in silver equivalent production compared to the previous year. The company has secured fresh capital through senior convertible bonds.

Current company information and press releases from Endeavour Silver (- https://www.resource-capital.ch/en/companies/endeavour-silver-corp/ -) and Vizsla Royalties (- https://www.resource-capital.ch/en/companies/mag-silver-corp/ -).

Sources:

In accordance with Section 85 of the German Securities Trading Act (WpHG) in conjunction with Article 20 of Regulation (EU) 2016/958 (MAR), we hereby disclose that authors/employees/affiliated companies of SRC swiss resource capital AG may hold positions (long/short) in issuers discussed. Remuneration/relationship: IR contracts/advertorial: Own positions (author): none; SRC net position: less than 0.5%; issuer’s stake in SRC ≥ 5%: no. Update policy: no obligation to update. No guarantee for the translation into German. Only the English version of this news release is authoritative.

Disclaimer: The information provided does not constitute any form of recommendation or advice. We expressly draw attention to the risks involved in securities trading. No liability can be accepted for any damage arising from the use of this blog. We would like to point out that shares and, in particular, warrant investments are generally associated with risk. The total loss of the capital invested cannot be ruled out. All information and sources are carefully researched. However, no guarantee is given for the accuracy of all content. Despite the utmost care, I expressly reserve the right to errors, particularly with regard to figures and prices. The information contained herein comes from sources that are considered reliable, but does not claim to be accurate or complete. Due to court rulings, the content of linked external sites is also our responsibility (e.g., Hamburg Regional Court, in its ruling of May 12, 1998 – 312 O 85/98), as long as we do not expressly distance ourselves from them. Despite careful content control, I assume no liability for the content of linked external sites. The respective operators are solely responsible for their content. The disclaimer of SRC swiss resource capital AG, which is available at https://www.resource-capital.ch/de/disclaimer-agb/, applies additionally.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41764802584

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()