Silver now in the league of critical metals

Breaking News:

Kathmandu Nepal

Sonntag, Feb. 1, 2026

– Advertisement/Advertising – This article appears on behalf of Skeena Gold & Silver Ltd. and Endeavour Silver Corp., companies with which SRC swiss resource capital AG has paid IR consulting contracts. Creator: SRC swiss resource capital AG · Author: Ingrid Heinritzi · First published: 10.09.2025, 04:50 p.m. Europe/Berlin

Critical minerals are characterized by their indispensability for national security and the economy. And their supply is potentially at risk. The US also wants to reduce its dependence on raw material imports as much as possible. Why silver now? Because silver is not only important for the jewelry industry and can serve as a good store of value, but silver is also indispensable for the increasing technologization of our world. The photovoltaic industry, battery manufacturing, and the medical sector all need silver. In lithium batteries, for example, silver increases service life and reduces the risk of short circuits. A world without lithium-ion batteries is already unimaginable today.

There is a structural deficit on the supply side for silver, while demand continues to grow. Around 837 million ounces of silver will be missing this year, which is more than the global annual production. It should therefore come as no surprise that the price of silver has exceeded the US$40 mark after 14 years. Many analysts still see significant upside potential and believe that silver is significantly undervalued. However, investors now also seem to be recognizing the appeal of silver investments. Silver ETFs are also enjoying inflows at the moment. The gold-silver ratio has fallen and is only slightly above average. More than half of silver demand is absorbed by industry. It is good that there are mining companies that own silver in their projects.

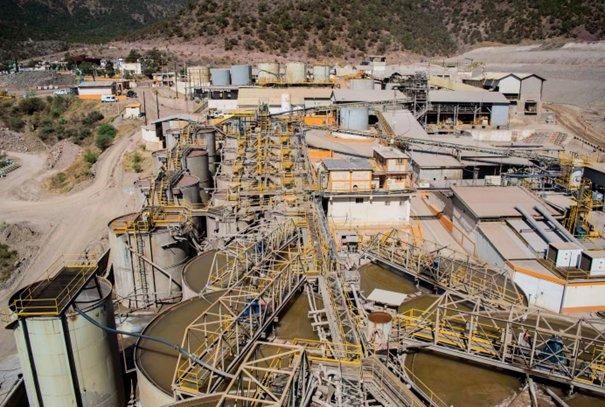

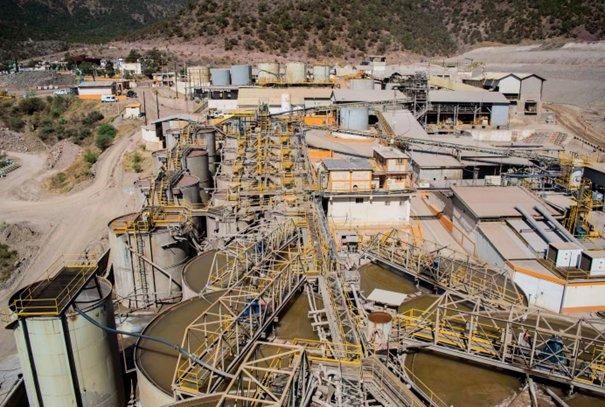

Endeavour Silver – https://www.commodity-tv.com/ondemand/companies/profil/endeavour-silver-corp/ – is one of the successful producers. The company’s projects are located in Mexico, Chile, and Peru. The second quarter brought more ounces sold at higher realized prices.

Skeena Gold & Silver – https://www.commodity-tv.com/ondemand/companies/profil/skeena-gold-silver-ltd/ – is developing a high-grade gold-silver project (Eskay Creek) in British Columbia, and two previously producing projects are still in focus.

Current company information and press releases from Endeavour Silver (- https://www.resource-capital.ch/en/companies/endeavour-silver-corp/ -) and Skeena Gold & Silver (- https://www.resource-capital.ch/en/companies/skeena-resources-ltd/ -).

Sources:

https://www.doi.gov/pressreleases/department-interior-releases-draft-2025-list-critical-minerals

In accordance with Section 85 of the German Securities Trading Act (WpHG) in conjunction with Article 20 of Regulation (EU) 2016/958 (MAR), we hereby disclose that authors/employees/affiliated companies of SRC swiss resource capital AG may hold positions (long/short) in issuers discussed. Remuneration/relationship: IR contracts/advertorial: Own positions (author): none; SRC net position: less than 0.5%; issuer’s stake in SRC ≥ 5%: no. Update policy: no obligation to update. No guarantee for the translation into German. Only the English version of this news release is authoritative.

Disclaimer: The information provided does not constitute any form of recommendation or advice. We expressly draw attention to the risks involved in securities trading. No liability can be accepted for any damage arising from the use of this blog. We would like to point out that shares and, in particular, warrant investments are generally associated with risk. The total loss of the capital invested cannot be ruled out. All information and sources are carefully researched. However, no guarantee is given for the accuracy of all content. Despite the utmost care, I expressly reserve the right to errors, particularly with regard to figures and prices. The information contained herein comes from sources that are considered reliable, but does not claim to be accurate or complete. Due to court rulings, the content of linked external sites is also our responsibility (e.g., Hamburg Regional Court, in its ruling of May 12, 1998 – 312 O 85/98), as long as we do not expressly distance ourselves from them. Despite careful content control, I assume no liability for the content of linked external sites. The respective operators are solely responsible for their content. The disclaimer of SRC swiss resource capital AG, which is available at https://www.resource-capital.ch/de/disclaimer-agb/, applies additionally.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()