Sierra madre announces strong Q2 2025 financial results, ramps up Coloso mine at la Guitarra

Breaking News:

Kathmandu Nepal

Freitag, Feb. 6, 2026

– 173,562 Silver Equivalent Ounces Sold During Second Quarter of Commercial Production

– Revenues of US$5.4 Million in Q2 2025, Gross Profit of US$1.3 Million

– C$19.5 Million Private Placement Closed Following Quarter-End

Sierra Madre Gold and Silver Ltd. (TSXV: SM) (OTCQX: SMDRF) ("Sierra Madre" or the "Company" – https://www.commodity-tv.com/ondemand/companies/profil/sierra-madre-gold-silver/) is pleased to provide financial results for the quarter ended June 30, 2025 (“Q2 2025”). Unless otherwise noted, all amounts are expressed in U.S. dollars. The Company will participate in a webinar to discuss the financial results on Monday, August 25 at 2pm ET. Registration details below.

Alex Langer, Chief Executive Officer, commented, “We are very happy with the results of only our second quarter of commercial operations at La Guitarra silver-gold mine complex in Mexico. The second quarter generated revenues of $5.4 million and a gross profit of $1.3 million, with both numbers showing growth over Q1 2025, despite Q2 2025 production being impacted by an earlier-than-usual onset of seasonal heavy rains in May, which resulted in power outages with correlating plant downtime. Our operating team remains focused on fine-tuning the mining and milling processes at the site, while ramping up the higher-grade Coloso mining centre where dewatering and underground development are underway. We expect grades to increase into the second half of 2025 from development work underway at both the Guitarra and Coloso mines.”

Mr. Langer continued, “Following quarter-end, we also closed a C$19.5 million financing supported by high-quality institutional shareholders. We are planning to deploy these funds in part to purchase additional equipment and implement improvements at the mine to reduce costs and increase production grades and volumes in the near-term. We are also finalizing plans for a plant expansion to increase capacity up from the current 500 t/d run rate, and preparing for a significant exploration program at the East District concessions, which will include a drill program of over 20,000 metres. On behalf of the entire team, I would like to thank our existing shareholders for their continued confidence and support and welcome our new shareholders who participated in this financing. Your commitment strengthens our ability to advance our strategic goals, and we look forward to continuing to build value for all stakeholders.”

Q2 2025 Highlights

Additional Operational Details

Outlook

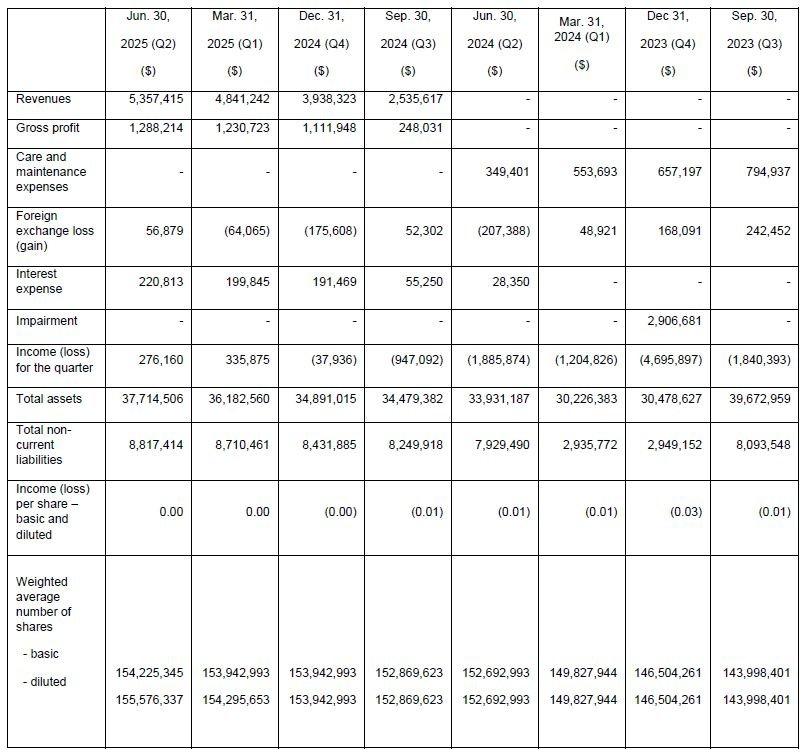

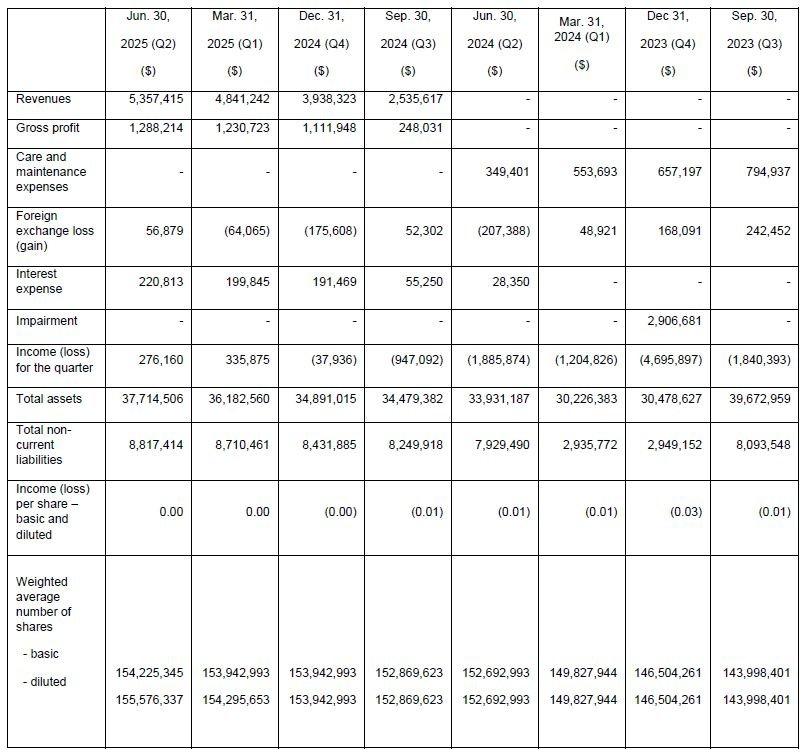

Quarterly Financial Overview

Selected financial information set out below is based on and derives from the unaudited condensed consolidated interim financial statements of the Company for each of the quarters listed, which have been prepared in accordance with IFRS, as applicable to quarterly reporting:

WEBINAR REGISTRATION

The Company will participate in a webinar on August 25, 2025, at 2:00 PM ET hosted by Adelaide Capital, reviewing Sierra Madre’s Q2 2025 results, including key operating and financial highlights and mine development updates. Questions can be submitted during the session or in advance to deborah@adcap.ca.

Registration link:

https://us02web.zoom.us/webinar/register/WN_wMse8zEUTuaoHxmQQvYdLw#/registration

A replay will be made available on the Adelaide Capital YouTube channel here: https://www.youtube.com/….

This news release should be read in conjunction with the Company´s condensed consolidated interim financial statements for the quarter ended June 30, 2025 and associated Management Discussion and Analysis (“MD&A”), both are available on SEDAR+ (www.sedarplus.ca) and on the Company´s website (www.sierramadregoldandsilver.com).

AgEq ounces produced have been determined using a ratio of 97.86 Au:Ag for Q2 2025 and 88.96 for Q1 2025. AgEq ounces sold have been determined using the actual silver and gold prices obtained during the quarter. The determined ratio used was 98.43 Au:Ag for Q2 2025 and 88.20 for Q1 2025.

The Company reports non-GAAP measures, which include Cash Cost of Production per Tonne, Cash Cost per AgEq ounce sold, All-in Sustaining Cash Cost per AgEq ounce sold and Average Realized Price per AgEq ounce sold and Adjusted EBITDA. These measures are widely used in the mining industry as a benchmark for performance, but do not have a standardized meaning and may differ from methods used by other companies with similar descriptions. See “Non-GAAP and Other Financial Measures” section of the Company’s Q2 2025 MD&A for definitions and reconciliations to GAAP measures.

Qualified Person

Mr. Gregory Smith, P. Geo, Director of Sierra Madre, is a Qualified Person as defined by NI 43-101, and has reviewed and approved the technical data and information contained in this news release. Mr. Smith has verified the technical and scientific data disclosed herein.

About Sierra Madre

Sierra Madre Gold and Silver Ltd. (TSXV: SM) (OTCQX: SMDRF) is a precious metals development and exploration company focused on the Guitarra mine in the Temascaltepec mining district, Mexico, and the exploration and development of its Tepic property in Nayarit, Mexico. The Guitarra mine is a permitted underground mine, which includes a 500 t/d processing facility that operated until mid-2018 and restarted commercial production in January 2025.

The +2,600 ha Tepic Project hosts low-sulphidation epithermal gold and silver mineralization with an existing historic resource.

Sierra Madre´s management team has played key roles in managing the exploration and development of silver and gold mineral reserves and mineral resources. Sierra Madre´s team of professionals has collectively raised over $1 billion for mining companies.

On behalf of the board of directors of Sierra Madre Gold and Silver Ltd.,

"Alexander Langer"

Alexander Langer

President, Chief Executive Officer and Director

778-820-1189

Contact:

investor@sierramadregoldandsilver.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch

Cautionary Note Regarding Production Decisions

The Company´s decision to place the mine into commercial production, expand a mine, make other production related decisions, or otherwise carry out mining and processing operations, is largely based on internal non-public Company data and reports from previous operations and the results of test mining and processing. The Company is not basing any production decisions on NI 43-101 compliant reserve estimates, preliminary economic assessments or feasibility studies and, as a result, there is greater risk and uncertainty as to future economic results from the Guitarra Mine Complex, including increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit, and a higher technical risk of failure than would be the case if a feasibility study were completed and relied upon to make a production decision.

Cautionary Note Regarding Forward-Looking Information

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This press release contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities legislation. The forward-looking statements herein are made as of the date of this press release only, and the Company does not assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise, except as required by applicable law. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budgets", "scheduled", "estimates", "forecasts", "predicts", "projects", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements include, without limitation, statements regarding discussions of future plans, including the expected timing of concentrate shipments; the Company increasing production; the Company receiving revenues on a weekly basis and such revenues allowing the Company to comfortably expand to without further capital needs; production and the expected timing and production levels thereof.

The forward-looking statements involve numerous risks and uncertainties, and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things, that predicted production levels will be achieved and that existing production levels will be maintained.

In making the forward-looking statements in this news release, the Company has applied certain material assumptions, including without limitation, that the Company will be able to execute its future plans as intended, that predicted production levels will be achieved and that existing production levels will be maintained.

Although management of the Company has attempted identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes.

SOURCE: Sierra Madre Gold and Silver Ltd.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()