Silver investments more popular than ever

Kathmandu Nepal

Donnerstag, Feb. 5, 2026

This comes as no surprise, given the various economic uncertainties and the very positive fundamentals for silver, with rising demand and a deficit in the silver market for years. Investors are therefore keen to snap up silver. On the CME (Chicago Mercantile Exchange), one of the world’s largest exchanges, net long positions rose by a whopping 163 percent compared to the end of 2024. Institutional investors have been active in silver. Interest among private investors is not yet as strong, but demand for bars and coins has risen. The important silver market in India also recorded growth of seven percent in the first half of 2025 compared to 2024.

In the US, on the other hand, retail demand has fallen by an estimated 30 percent so far. If the silver price approaches or even exceeds US$40 per ounce soon, new entrants are to be expected, but also profit-taking. It remains to be seen which will prevail. Basically, more attention should be paid to silver as a precious metal, because it is indispensable in many areas. It is used in batteries, semiconductors, and in the wind and solar industries—in fact, in almost everything we touch or see every day. That is why many experts see great potential for profits in silver in particular. Mining companies with silver in their projects are therefore also coming into focus.

Vizsla Silver – https://www.commodity-tv.com/ondemand/companies/profil/vizsla-silver-corp/ – owns the former gold-silver project Panuco in Mexico. A preliminary economic study looks very promising, and the company aims to become a leading global silver company.

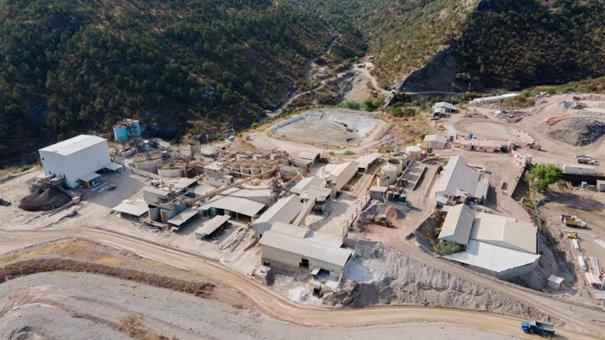

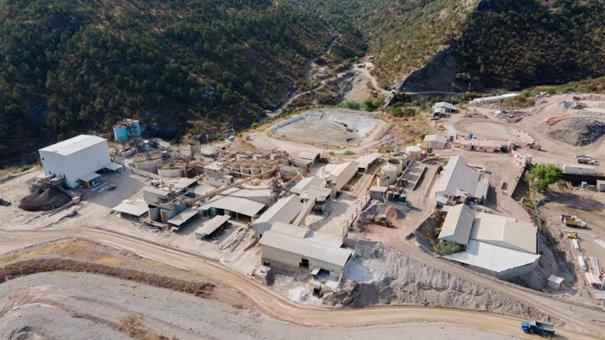

Endeavour Silver – https://www.commodity-tv.com/ondemand/companies/profil/endeavour-silver-corp/ – is successfully producing silver from its projects in Mexico, Peru, and Chile. The second quarter produced nearly 1.5 million ounces of silver.

Current company information and press releases from Endeavour Silver (- https://www.resource-capital.ch/en/companies/endeavour-silver-corp/ -) and Vizsla Silver (- https://www.resource-capital.ch/en/companies/vizsla-silver-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()