Green Bridge Metals Enters into Definitive Agreement to Option Large Bulk Tonnage Copper-Nickel-PGE Serpentine Project, Duluth Complex, Minnesota, USA

Breaking News:

Kathmandu Nepal

Mittwoch, Feb. 4, 2026

CEO, David Suda stated: “We are thrilled to have entered into a definitive agreement with our partners at EMI and the Gilliam family, who have privately held and astutely advanced this property. Together we plan to unlock value at this opportune commodity price environment and government tailwinds in the United States. We would like to thank everyone at EMI together with the Gilliam and Arnold families for all the work they have done to identify and advance the prospect at Serpentine and for the opportunity to work together going forward with development.”

Highlights of the Serpentine Deposit are:

David Suda further stated: “Never before public, Serpentine is a highly strategic asset situated in the middle of what could potentially become one of the world’s largest and most important copper-nickel and other critical metals production hubs. There is currently strong momentum for domestic mining in the United States and the need for copper, nickel, cobalt and other critical metals is ever-present. By gaining access to Serpentine, Green Bridge combines the Company’s existing exploration upside at South Contact Zone with the development of Serpentine. With this Green Bridge offers investors leverage to significant opportunities with near-term catalysts and long-term value creation across multiple properties in North America.”

The material terms of the Option, as well as a description of the Serpentine Project are contained in the Company’s news release dated May 8, 2025.

Pursuant to the Definitive Agreement, the Company will acquire the Option upon completion of several conditions, including receipt of regulatory approval and other customary conditions. It is anticipated that the foregoing conditions will be met and the Company will acquire the Option on or prior to September 30, 2025.

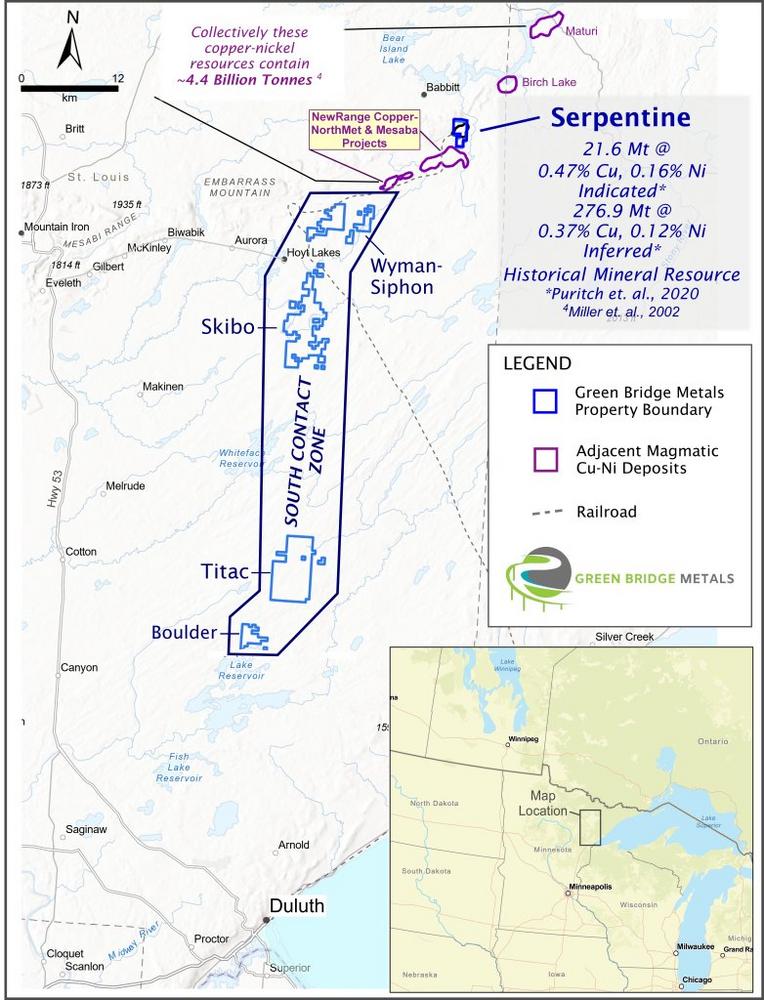

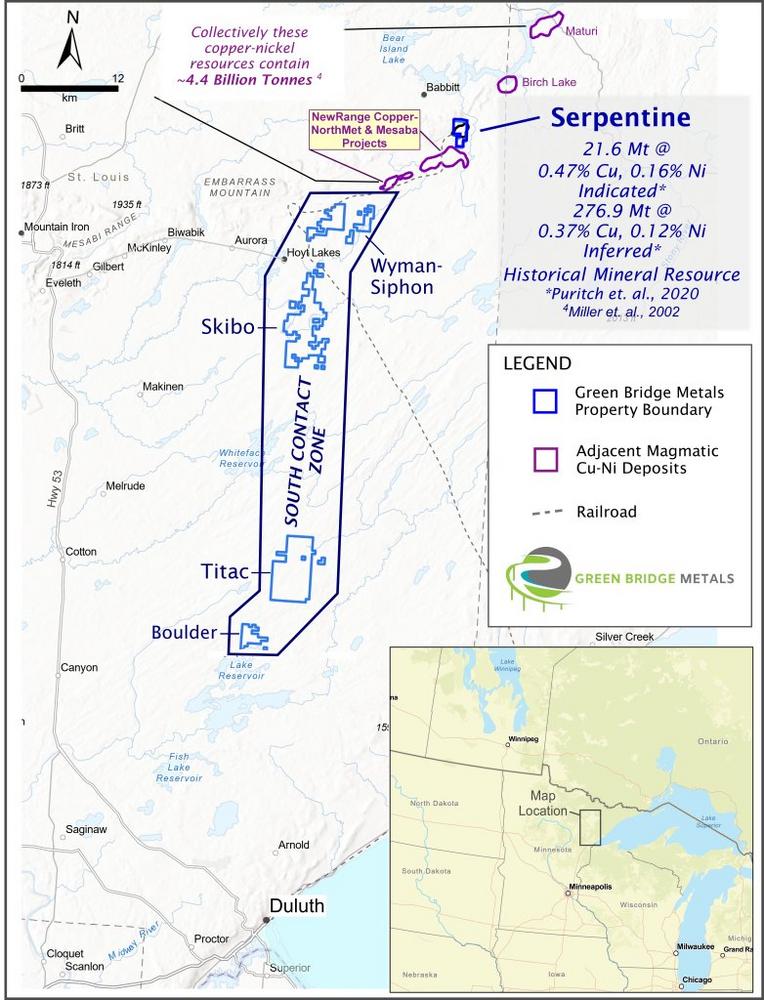

The Serpentine Project is located in the Mesabi Range mining district, along trend with several well-known significant deposits such as Maturi (1.8 Billion tonnes) (Barber et. al, 2014) and Mesaba (2.2 Billion tonnes) (Welhener and Crowie 2022) (Figure 1) and has access to substantial mining infrastructure in the long-lived mining district of the Iron Range, Minnesota. Serpentine has a historical National Instrument (NI) 43-101 (“NI 43-101”) Inferred Mineral Resource Estimate (“Historical Estimate”) of 277Mt @ 0.37% copper and 0.12% nickel and an Indicated Mineral Resource Estimate of 22Mt @0.47% copper and 0.16% nickel (Purtich et al., 2020). The Historical Estimate states that it was prepared pursuant to NI 43-101 and in conformity with generally accepted “CIM Estimation of Mineral Resource and Mineral Reserves Best Practices” guidelines. Mineral Resources have been classified in accordance with the “CIM Standards on Mineral Resources and Reserves: Definition and Guidelines”. The Company believes that an option in respect of the Serpentine Project is a cornerstone for value creation and complements the existing high-potential exploration portfolio along the South Contact Zone.

1. Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

2. The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

3. The Mineral Resources in this Technical Report were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

4. No Mineral Resources are classified as Measured.

5. Totals may not sum due to rounding.

6. Cut-off = NSR $8.50/t; Cu-Equivalent (Cu-Eq)% =NSR/49.92.

7. Cu = copper, CuEq = copper equivalent, Ni = nickel, NSR = net smelter return.

* The estimates by Puritch et al. (2020) in this new release were completed to current CIM standards and use current classifications; however, they were completed on behalf of another issuer and have not been reviewed in the context of current metal prices and mining/processing costs and therefore are all considered historical in nature. A QP has not done sufficient work to evaluate these resources as current resources.

Ajeet Milliard, Chief Geologist at the Company is a Qualified Person within the meaning of NI 43-101 and is satisfied that the analytical and testing procedures used are standard industry operating procedures and methodologies, and has reviewed, verified, and approved the technical information disclosed in this news release, including sampling, analytical and test data underlying the technical information.

About Green Bridge Metals

Green Bridge Metals Corporation is a Canadian based exploration company focused on acquiring ‘critical mineral’ rich assets and the development of the South Contact Zone (the “Property”) along the basal contact of the Duluth Complex, north of Duluth, Minnesota. The South Contact Zone contains bulk-tonnage copper-nickel and titanium-vanadium in ilmenite hosted in ultramafic to oxide ultramafic intrusions. The Property has exploration targets for bulk-tonnage Ni mineralization, high grade Ni-Cu-PGE magmatic sulfide mineralization and titanium.

ON BEHALF OF GREEN BRIDGE METALS,

“David Suda”

President and Chief Executive Officer

For more information, please contact:

David Suda

President and Chief Executive Officer

Tel: 604.928-3101

investors@greenbridgemetals.com

Forward Looking Information

Certain statements and information herein, including all statements that are not historical facts, contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Such forward-looking statements or information include but are not limited to statements or information with respect to: the exploration and development of the Serpentine Property and the completion of the conditions to acquire the Option.

Although management of the Company believe that the assumptions made and the expectations represented by such statements or information are reasonable, there can be no assurance that forward-looking statements or information herein will prove to be accurate. Forward-looking statements and information by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. These risk factors include, but are not limited to: the exploration and development of the Serpentine Property may not result in any commercially successful outcome for the Company; the conditions to acquire the Option may not be met as currently contemplated, or at all; risks associated with the business of the Company; business and economic conditions in the mining industry generally; changes in general economic conditions or conditions in the financial markets; changes in laws (including regulations respecting mining concessions); and other risk factors as detailed from time to time.

The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()