Fury Finalizes Drill Targeting at its Newly Acquired Sakami Gold Project

Breaking News:

Kathmandu Nepal

Freitag, Jan. 30, 2026

1. Discovery along a 23-kilometre (km) long gold-bearing structural corridor at the Juliette target;

2. Confirm historical mineralized intercepts at the La Pointe and La Pointe Extension targets;

3. Stepout drilling along strike and down plunge of a high-grade corridor identified at La Pointe Extension.

Historical drilling at Sakami has intercepted gold mineralization across widths of up to 75 m and to a depth of up to 500 m below surface with intercepts of 7.79 g/t gold (Au) over 3.0 m from drill hole PT21-182; 8.70 g/t Au over 7.0 m from drill hole PT21-187; 4.28 g/t Au over 4.5 m from drill hole PT17-102 and 3.89 g/t Au over 14.90 m from drill hole PT18-116 (Figures 2 and 3).

“We are looking forward to commencing drilling later this month at the Sakami project, following our successful acquisition of Quebec Precious Metals. This project offers exciting discovery potential, and we believe it holds significant promise for value creation,” commented Tim Clark, CEO of Fury.

“The newly acquired Sakami project represents an excellent opportunity for new discovery and building on the gold mineralization identified to date. The targeting matrix incorporates all available data and is extremely robust with goals ranging from brand new regional discovery through to confirmation and extension drilling,” commented Bryan Atkinson, P.Geol., SVP Exploration of Fury.

Sakami Project

The Sakami project covers approximately 14,250 hectares (ha) 30 km to the east of the paved Billy Diamond Highway. The Project straddles the prospective structural corridor marking the contact between the Opinaca and La Grande Geological subprovinces, where gold mineralization has been identified across over 23 km (Figure 1). Gold mineralization is located at the base of a sulphide rich horizon located along and proximal to regional-scale shearing, marking the contact between the two geological subprovinces (Figures 2, 3, and 4).

Previously identified gold mineralization at both La Pointe and La Pointe Extension remains open to depth and along strike, which will be a primary target for follow-up. The undrilled Juliette target, located 1 km south of La Pointe Extension, has a similar Induced Polarization (IP) geophysical chargeability signature to the La Pointe and La Pointe Extension targets and represents an excellent opportunity to discover additional gold mineralization along the highly prospective gold-bearing structure (Figure 4).

The three priorities of the first phase drilling campaign are all focused on advancing Fury’s technical understanding of the prospectivity of the Sakami project. Firstly, the drilling will target regional discovery at Juliette. The second priority of the drilling is to confirm the nature and extent of mineralization identified in historical drilling at La Pointe and La Pointe Extension. Lastly, the drilling will look to extend high-grade shoots to depth beneath the historical drilling.

Éléonore South Project

The Éléonore South project is strategically located in an area of prolific gold mineralization with Dhilmar Ltd.’s Éléonore Mine (formerly owned by Newmont Corporation) to the north and Sirios Resource’s Cheechoo Deposit to the east (Figure 5). Two distinct styles of mineralization have been identified to date within the property boundaries: structurally controlled quartz veins hosted within sedimentary rocks similar to the high-grade mineralization observed at the Éléonore Mine; and intrusion-related disseminated gold mineralization similar to that seen within the Cheechoo Tonalite.

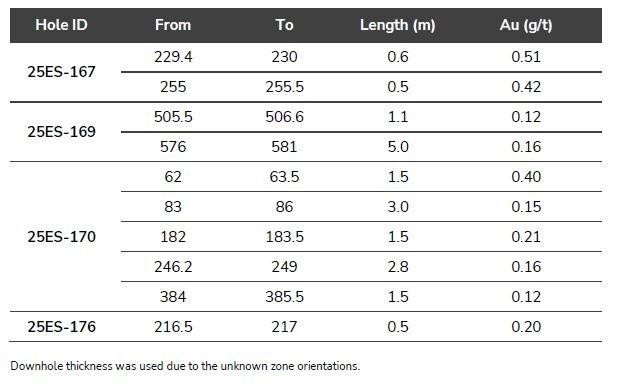

The first phase of drilling was completed in the Spring of 2025, comprising 12 diamond drill holes for approximately 4,930 m across a 2 x 3 km target area. The drilling targeted axial planar structures within the core of the folded Low Formation sediments with associated gold and multi-element biogeochemical anomalies. Four of the twelve drill holes intercepted low-grade gold mineralization across widths of up to 5 m and up to five zones in a single drill hole (25ES-170) (Table 1). The low-grade gold mineralization intercepted lies within an east-west, steeply dipping to the south structural corridor with quartz veining and associated strong, broad zones of carbonate + silica + tourmaline +/- diopside alteration (Figure 6). The structural corridor is interpreted to be an axial planar feature related to broad regional scale folding within the favourable Low Formation sedimentary package. Gold is associated with bismuth and tellurium within altered bedded wackes and argillites of the Low Formation.

The drilling did not intercept arsenopyrite, which is a primary indicator of gold mineralization at the Éléonore Mine. Moderate arsenic anomalism was used in the targeting of the initial drilling in order to filter out the high background arsenic in the regional sedimentary package. Future drilling will target moderate to high arsenic anomalism with associated gold anomalism within the identified structural corridor in order to filter out the right concentration of arsenic associated with mineralization and not primary arsenic associated with lithology.

“Fury’s technical team has learned a lot from the limited first phase of drilling at the Éléonore-style target,” stated Bryan Atkinson, P.Geol., SVP Exploration of Fury. “With just twelve drill holes we were able to confirm the same favourable geological and structural settings as the Éléonore Mine are present at Éléonore South and intercept broad zones of alteration with associated gold mineralization beneath up to 45 m of cover. Numerous untested targets remain within the six square kilometre target area, which warrant follow-up in future drill campaigns.”

Sampling and Assaying Disclosure

2025 Fury Drilling

Analytical samples for the Drill Program were taken by sawing NQ diameter core into equal halves on site with one half sent to ALS Chemex in Sudbury, Ontario, Canada for preparation and analysis. All samples were assayed using a 50 g nominal weight fire assay with inductively coupled plasma – atomic emission spectrometry finish (Au-ICP22) and multi-element four acid digest ICP-AES/ICP-MS method (ME-MS61). Where Au-ICP22 results were greater than 0.5 ppm Au the assay was repeated with a 50 g nominal weight fire assay with atomic absorption finish (Au-AA24). Samples containing more than 10 ppm by Au-AA24 were re-assayed with 50 g nominal weight fire assay with gravimetric finish (Au-GRA22). QA/QC programs using internal standard samples, field and lab duplicates and blanks indicate good overall accuracy and precision.

Historical Sakami Diamond Drilling

Analytical samples were taken by manually splitting NQ diameter core into equal halves on site with one half being sent to ALS Chemex in Val D’or, QC for preparation and analysis. All samples were assayed using a 30 g nominal weight fire assay with atomic absorption finish (Au-AA24). QA/QC programs using internal standard samples, field and lab duplicates and blanks indicate good overall accuracy and precision. Fury has completed a review of the historical Sakami drill database and found no significant errors. Reported intervals were calculated using Au grade*thickness no less than 2.0g/t*m with grade no less than 1.0g/t, maximum consecutive dilution 2m. Due to the unknown orientation of the zones downhole thickness was used.

Technical and scientific information disclosed from neighboring properties does not necessarily apply to the current project or property being disclosed.

Valérie Doyon, P.Geo, Senior Project Geologist at Fury, is a "qualified person" within the meaning of Canadian mineral projects disclosure standards instrument 43-101 and has reviewed and approved the technical disclosures in this press release.

About Fury Gold Mines Limited

Fury Gold Mines Limited is a well-financed Canadian-focused exploration company positioned in two prolific mining regions across Canada and holds an 11.8 million common share position in Dolly Varden Silver Corp (14.5% of issued shares). Led by a management team and board of directors with proven success in financing and advancing exploration assets, Fury intends to grow its multi-million-ounce gold platform through rigorous project evaluation and exploration excellence. Fury is committed to upholding the highest industry standards for corporate governance, environmental stewardship, community engagement and sustainable mining. For more information on Fury Gold Mines, visit www.furygoldmines.com.

For further information on Fury Gold Mines Limited, please contact:

Margaux Villalpando, Manager Investor Relations

Tel: (844) 601-0841

Email: info@furygoldmines.com

Website: www.furygoldmines.com

In Europe

Swiss Resource Capital AG

Jochen Staiger & Marc Ollinger

info@resource-capital.ch

www.resource-capital.ch

Forward-Looking Statements and Additional Cautionary Language

This release includes certain statements that may be deemed to be "forward-looking statements" within the meaning of applicable securities laws, which statements relate to the future exploration operations of the Company and may include other statements that are not historical facts. Forward-looking statements contained in this release primarily relate to statements that suggest that the future work at Sakami and Éléonore South will potentially increase or upgrade the gold resources.

Although the Company believes that the assumptions and expectations reflected in those forward-looking statements were reasonable at the time such statements were made, there can be no certainty that such assumptions and expectations will prove to be materially correct. Mineral exploration is a high-risk enterprise.

Readers should refer to the risks discussed in the Company’s Annual Information Form and MD&A for the year ended December 31, 2024 and subsequent continuous disclosure filings with the Canadian Securities Administrators available at www.sedarplus.ca and the Company’s Annual Report available at www.sec.gov. Readers should not place heavy reliance on forward-looking information, which is inherently uncertain.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

![]()