All for One Group SE confirms its preliminary results: Considerable sales growth in financial year 2022/23

Breaking News:

Kathmandu Nepal

Freitag, Mai 17, 2024

Final results 2022/23:

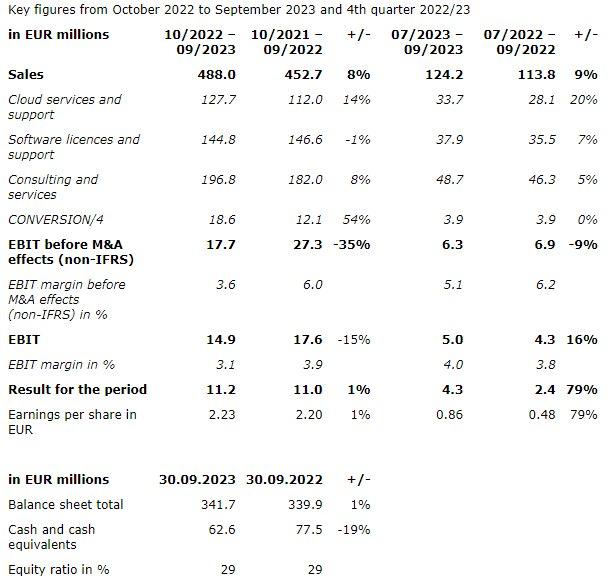

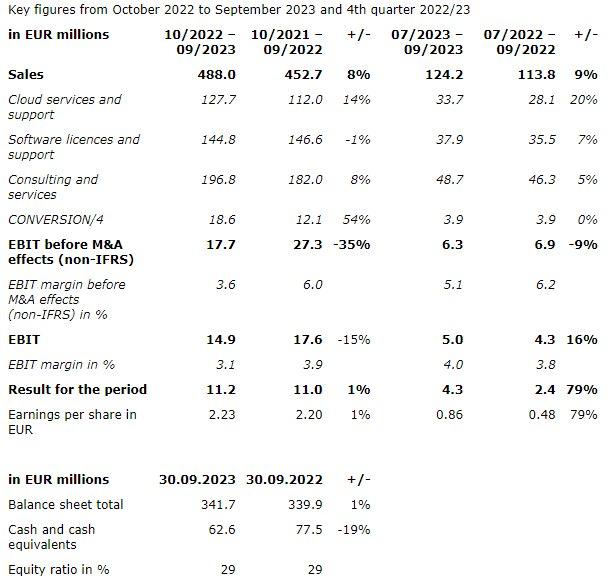

All for One Group SE, a leading consulting and IT Group focusing on SAP solutions, products and services, published its Annual Report 2022/23 today and confirmed the preliminary results announced in November. In the financial year just ended, the Group generated sales of EUR 488.0 million, up 8% compared to the prior-year sales of EUR 452.7 million. The increase is indicative of the strong demand for products and services for migrating to SAP S/4HANA, for which All for One offers CONVERSION/4 – a model that extends far beyond just technical conversion and which is unparalleled in the marketplace. The share of total sales attributable to recurring revenues increased to 55% compared to 53% in financial year 2021/22. This positive sales performance is enabling All for One Group to strengthen its outstanding competitive position as a leading provider of SAP services in the DACH region and Poland, ranking first for both SAP conversions and SAP cloud business in the Central and Eastern European region (H1 2023).

In financial year 2022/23, EBIT before M&A effects (non-IFRS) totalled EUR 17.7 million (2021/22: EUR 27.3 million) and EBIT EUR 14.9 million (2021/22: EUR 17.6 million). This decrease was essentially due to non-recurring expenditure of EUR 8.4 million incurred in connection with the restructuring of the CORE (ERP and collaboration solutions) segment. By contrast, the result for the period increased by 1% to EUR 11.2 million (2021/22: EUR 11.0 million) while earnings per share also rose by 1% to EUR 2.23 (2021/22: EUR 2.20).

Dividend proposal: EUR 1.45 per share

To ensure shareholders participate appropriately in the success of the company, the management and supervisory boards plan to ask the annual general meeting on 14 March 2024 to approve payment of a dividend of EUR 1.45 per share for financial year 2022/23 (prior year: EUR 1.45). Based on a share price of EUR 45.50 on 11 December 2023, this would equate to a dividend yield of 3.2%. The distribution quota would be 65% of Group earnings, equivalent to a payout total of EUR 7.2 million.

Well positioned for profitable growth

After completing the restructuring of the CORE segment and by accelerating the expansion of the globally operating service organisation, All for One Group has created a solid foundation for further profitable growth in the year under review. The Group is reaping the benefits of the continuing trend towards digitalisation both in businesses and along the value and supply chains. SAP’s S/4HANA forms the digital core, together with its add-ons and innovations.

Strong demand is being witnessed particularly for transformations to SAP S/4HANA using All for One Group’s CONVERSION/4 model, cloud-based solutions – which are increasingly more or less becoming the standard – and ongoing consulting services and adaptations to reflect technological advancements. The implementation of solutions allowing a more sustainable alignment of business processes, together with the management and control of the same, is also expected to increase. In the course of this development, All for One is able to benefit from its outstanding competitive edge as a leading SAP provider in the German-speaking region and Poland and as the leader in the field of SAP conversions and SAP cloud solutions (H1 2023). Further growth is expected to be accompanied by an above-average increase in profitability achieved through offering top-quality consulting services, increasing automation of the conversion processes and providing long-term support to companies when implementing active services. Added to which, utilising the Regional Delivery Centers in Egypt, Poland and Turkey will enable an improved cost structure.

»We did our homework properly in the financial year just ended. We put the spotlight on our CONVERSION/4 model – which occupies an outstanding position in the competitive environment – and optimised structures at key points within the Group. In doing so, we have laid the foundations both for future growth and improved profitability«, explained Co-CEO Michael Zitz. »All for One Group is now excellently positioned to reap the benefits of a dynamic and innovative growth market focusing on digitalisation and transformation. We are able to deliver performance to our customers that adds measurable value.«

ESG report published

All for One Group is publishing its Sustainability Report 2022/23 at the same time as the Annual Report. In the former, All for One Group documents its commitment to sustainable corporate governance and explains the progress made in the year under review.

Sustainability targets for ESG promissory note loan published

In May 2022, All for One Group SE issued a EUR 40 million promissory note loan with sustainability covenants. The promissory note loan includes an ESG bridge anchoring the sustainability element. At the time of issue, it was agreed that two performance metrics focusing on the environment, society and/or corporate governance would be specified by the end of 2022/23 and that the corresponding targets for future test times would be disclosed. Failure to meet these targets would result in a higher interest rate. Target achievement will be tracked – and the interest rate adjusted if necessary – at the respective test times.

The performance metrics for the sustainability component of the promissory note loan are: »Reduction of CO2 emissions (Scopes 1 and 2)« within the Group and – as a social target – »Increasing the proportion of women in management«. At the end of financial year 2022/23, CO2 emissions were at 6,279 tCO2e and the target is to reduce this 2022/23 reference figure by 35% by 30 September 2028. The proportion of women in management is currently 19.9% and the target is to increase the proportion by 8% by 2028.

»By publishing these ESG performance metrics for our promissory note loan we are honouring our self-declared commitment and linking funding to sustainability at All for One. The performance indicators we have chosen represent examples of our responsible corporate governance and require corresponding changes in the culture of our Group. We also expect lower CO2 emissions and the associated operational efforts, and the greater proportion of women in management to produce very clear benefits in respect of our business performance«, explained Stefan Land, CFO at All for One Group SE.

Guidance

Based on operational performance in the 1st quarter 2023/24 and the good order pipeline, All for One is witnessing a successful start to the new financial year. Given its outstanding position in the SAP environment and the optimisations and improvements that were put in place last year, the management board continues to expect the Group to reap above-average benefits from a growing market for IT consulting and services. Which should, in turn, translate into further sales growth and greater profitability.

As things stand at present, presuming a continued robust and steady stream of incoming orders and a stable and broad customer base and based on the growth rates predicted for the IT consulting and services market, the management board of All for One Group expects sales to be between EUR 505 million and EUR 525 million in financial year 2023/24 (2022/23: EUR 488.0 million). EBIT before M&A effects (non-IFRS) is predicted to be in a range between EUR 32 million and EUR 36 million (2022/23: EUR 17.7 million).

In light of the above, the management board is also confirming its medium-term outlook. All for One Group expects robust organic sales growth over the coming years in the mid-single-digit percentage range (depending partly on future inflation levels) that will be supplemented by inorganic growth in areas of the portfolio offering future promise. The EBIT margin before M&A effects (non-IFRS) is expected to reach a range of 7% to 8% as early as financial year 2024/25.

The full Annual Report 2022/23 of All for One Group SE is available for download from the Investor Relations section on the Group website https://www.all-for-one.com/….

All for One Group’s Sustainability Report 2022/23 can be accessed at https://www.all-for-one.com/….

All for One Group is an international IT, consulting and service provider with a strong SAP focus. Determined to translate technology into a clear business advantage, the Group specialises in specific sectors of industry, accompanying and supporting the sustainable transformation of its more than 3,500 midmarket customers in Germany, Austria, Poland and Switzerland on their journey to the cloud. Focus is on SAP S/4HANA, which forms the digital core for the industry-specific processes throughout a business. All for One Group is the leading SAP partner in Central and Eastern Europe, both for transformations to SAP S/4HANA using its innovative CONVERSION/4 model, and for SAP cloud business.

In financial year 2022/23, All for One Group SE generated sales of EUR 488 million with its team of almost 3,000 employees. The Group is based in Filderstadt near Stuttgart, in Germany, and is listed in the Prime Standard on the Frankfurt Stock Exchange.

www.all-for-one.com/ir-english

All for One Group SE

Rita-Maiburg-Str. 40

70794 Filderstadt

Telefon: +49 (711) 78807-260

Telefax: +49 (711) 78807-222

http://www.all-for-one.com

![]()